Jakarta - Dua perempuan asal Papua membuktikan jika perempuan tak kalah dengan laki-laki. Mereka berhasil membuktikan perempuan bisa menjadi pilot.

Garuda Punya Pilot Perempuan Pertama dari Papua - detikFinance

Baca Selanjutnya

Jakarta - Dua perempuan asal Papua membuktikan jika perempuan tak kalah dengan laki-laki. Mereka berhasil membuktikan perempuan bisa menjadi pilot.

BEI mengocok ulang anggota LQ45 untuk periode Agustus 2019 hingga Januari 2020.

Jakarta - Dua perempuan asal Papua membuktikan jika perempuan tak kalah dengan laki-laki. Mereka berhasil membuktikan perempuan bisa menjadi pilot.

Jakarta, CNBC Indonesia - Dibuka melemah 0,23% ke level 6.362,11, Indeks Harga Saham Gabungan (IHSG) menghabiskan mayoritas waktunya pada ...

Dream - Hidup tidak selalu berada di kondisi aman. Ada kalanya situasi sulit mendera hingga kita tidak bisa berbuat apa-apa. Kesulitan ekonomi adalah kondisi ...

היחצ"ן הגיש בחמשת החודשים האחרונים את "רני ושרון" ברשת 13. במכתב הפרישה ביקש כי את מקומו בתוכנית תתפוס אשה.

לסיקור המלא ב-חדשות GoogleJakarta - Dua perempuan asal Papua membuktikan jika perempuan tak kalah dengan laki-laki. Mereka berhasil membuktikan perempuan bisa menjadi pilot.

Wall Street memerah pasca The Fed yang menurunkan suku bunga acuannya, tapi tidak memberikan sinyal penurunan lanjutan.

Jakarta - Dua perempuan asal Papua membuktikan jika perempuan tak kalah dengan laki-laki. Mereka berhasil membuktikan perempuan bisa menjadi pilot.

Segmen bisnis emas membantu United Tractors (UNTR) mengurangi tekanan di sektor lain.

Pernyataan Kepala BKPM Thomas Lembong yang mengutip riset Google-Temasek yang sebut Singapura punya empat startup unicorn sementara Indonesia ...

Jakarta - Dua perempuan asal Papua membuktikan jika perempuan tak kalah dengan laki-laki. Mereka berhasil membuktikan perempuan bisa menjadi pilot.

Segmen bisnis emas membantu United Tractors (UNTR) mengurangi tekanan di sektor lain.

Ide tebu rakyat adalah ide Kasimo, setelah melihat rakyat petani yang sewakan tanahnya menderita.

Jakarta - Dua perempuan asal Papua membuktikan jika perempuan tak kalah dengan laki-laki. Mereka berhasil membuktikan perempuan bisa menjadi pilot.

Segmen bisnis emas membantu United Tractors (UNTR) mengurangi tekanan di sektor lain.

CNBC's Jim Cramer on Wednesday suggested that firms should shuffle the analysts they have assigned to cover Apple.

The company needs a new cohort of researchers that will give more weight to its subscription service business than its iPhone sales, the "Mad Money" host said.

"People just don't understand how to evaluate the new Apple. They view it as a sagging hardware story," he said. "People keep underestimating Apple's new business model."

Apple deserves analysts that are focused on entertainment or consumer packaged goods, Cramer argued. Tech analysts, he said, that cover hardware and software companies "won't understand any of this."

On Tuesday, Apple reported a top- and bottom-line beat in its fiscal third-quarter. However, iPhone sales fell 12% year-over-year while its service revenue, which includes Apple Music and App Store fees, grew 13% in the same period. The company also recorded 50% growth in its wearables division, think Apple Watch and AirPods, while iPhone sales accounted for less than half of total revenue for the first time in about seven years.

The company has been shifting focus from hardware to services as the iPhone replacement cycle becomes lengthier and the subscription economy grows.

Apple's quarter performance was well received by Wall Street analysts, but declining iPhone revenue is a major cause of concern among the community, CNBC reported. The article notes Deutsche Bank analyst Jeriel Ong said: "we continue to have questions around the long-term growth of iPhones, we are remaining on the sidelines."

Coming off the quarter report, the host thought Apple deserved a string of price target increases and upgrades to buy fro hold.

"My theory is that these analysts are the same gang that cover the other FAANG stocks — Facebook, Amazon, Netflix and Alphabet," he said. "Within FAANG, Apple is the slowest grower by far."

Cramer said Apple should begin revealing the number of subscribers it has so that analysts can build models to measure long customers are sticking around on a service.

"If the churn is low, you can figure out the lifetime value of a subscription ... It's a terrific annuity if you have low churn," he said. "A tech analyst who covers hardware or software companies won't understand any of this."

Shares of Apple climbed more than 2% during the session to close above $213.

"Until Apple gets this kind of duel coverage, I think the stock will remain ridiculously cheap," Cramer said. "But give it to an entertainment analyst or a consumer packaged goods analyst, and I'm betting the stock would catch fire."

Disclosure: Cramer's charitable trust owns shares of Apple, Facebook, Amazon and Alphabet.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

- Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com

Sri Mulyani pun berpesan di depan para CPNS untuk tetap menjadi bagian dari NKRI dan tidak berkubu-kubu Halaman all.

Lihat liputan lengkap di Google BeritaJakarta - Dua perempuan asal Papua membuktikan jika perempuan tak kalah dengan laki-laki. Mereka berhasil membuktikan perempuan bisa menjadi pilot.

Jakarta - PT Pertamina (Persero) melakukan serah terima Proyek Langit Biru Cilacap (PLBC) dari JGC kontraktor EPC asal Jepang. Masa pembangunan proyek ...

Segmen bisnis emas membantu United Tractors (UNTR) mengurangi tekanan di sektor lain.

Beban bank Badan Usaha Milik Negara (BUMN) semakin berat.

A container ship moored at the Piraeus Container Terminal in Greece on June 6, 2016.

Alkis Konstantinidis | Reuters

While investors look for clues about the health of the global economy, a research and analytics unit under S&P Global said a "hidden" segment of debtors is flashing early signs of trouble.

Those borrowers are small companies that are not rated by S&P Global Ratings, according to the agency's sister division, S&P Global Market Intelligence. A credit rating is an assessment on a government or company's ability to repay its debt.

There are many reasons why borrowers choose not to seek a credit rating, including cost savings, infrequent bond issuance and investors' familiarity with the brand. Well-known companies that have in the past opted against a credit rating include Italian luxury fashion house Prada and German sportswear brand Adidas.

The unrated entities are like the canary in the mine. They are the ones that usually start to default first — before you see trouble happening among the rated entities — because they are the weaker link.

Michelle Cheong

director, S&P Global Market Intelligence

Generally, though, many entities without an S&P credit rating are small companies that are likely to be the first victims in an economic downturn, said Michelle Cheong, director and global product development lead for credit solutions data at S&P Global Market Intelligence.

That group is "very much a hidden, under the radar" segment, Cheong told CNBC in a phone call on Monday. That's because unrated borrowers are much smaller in size collectively: Their total assets have consistently been less than 10% of their rated peers' over the last five years.

"The unrated entities are like the canary in the mine. They are the ones that usually start to default first — before you see trouble happening among the rated entities — because they are the weaker link," she added.

Total assets by rated and unrated entities in FY 2018

Source: S&P Global Market Intelligence (June 28, 2019)

Cheong identified possible risks among unrated issuers by studying indicators such as earnings estimates and revenue growth. She also looked for potential distress signals including public announcements that appear "negative," such as corporate restructuring.

Her analysis, which will be presented on Wednesday at the S&P Global Market Intelligence Annual Singapore Conference, found the financial conditions facing unrated entities weakening across sectors and regions. With the global economy now slowing down amid an ongoing trade war between the U.S. and China, further deterioration in business sentiment could result in a sudden increase in defaults.

One worrying trend, Cheong said, is falling profit margins among unrated entities. A reason behind that is over-investment in less profitable projects due to the availability of cheap credit in the last few years, she explained.

Analysts have long warned about the dangers of rising debt fueled by low interest rates globally. The low-rate environment came about after central banks around the world adopted easier monetary policies to stimulate the economy after the financial crisis.

The International Monetary Fund said in its Global Financial Stability Report in April that low interest rates have resulted in a higher level of risky debt in the economy. That has increased vulnerabilities in the financial system, which could worsen effects of an economic downturn, according to the IMF.

The analysis by S&P Global Market Intelligence found unrated entities in China, the U.K. and the technology sector in Asia Pacific are among the most at risk of a sudden spike in defaults.

Chinese firms have defaulted at an "unprecedented" level this year, while the possibility of the U.K. leaving the European Union without a deal has hurt companies' prospects, according to the study. At the same time, the technology sector in Asia Pacific has been hit by a slowdown in demand and global trade tensions.

Investors have been looking for signs of trouble — especially after the U.S., the world's largest economy, marked its longest economic expansion in history.

One recession predictor occurred in March: The yield on the U.S. 10-year Treasury note dipped below that of the three-month paper. The phenomenon, referred to as an inversion in the yield curve, has occurred before each economic recession in the past 50 years.

Cheong's analysis of companies not rated by S&P doesn't date that far back, but she said unrated borrowers "at the bottom of the barrel" of the U.S. real estate sector (which are thought to have contributed to the global financial crisis) started to face problems in repaying their debt in 2005 and 2006.

As she noted, that's "way before all the news started hitting" about the subprime crisis, she said.

But Cheong said merely watching the unrated segment may not be enough to spot a definite turn in the economic cycle. She explained that studying other trends such as defaults among speculative-grade bonds and the number of credit rating downgrades compared to upgrades could help investors develop a better picture of the global economic conditions.

"Kami bertahan dalam hal ini tetapi tubuh kami masih menderita karenanya. Mengerikan hidup di bawah kondisi kualitas udara yang buruk,"

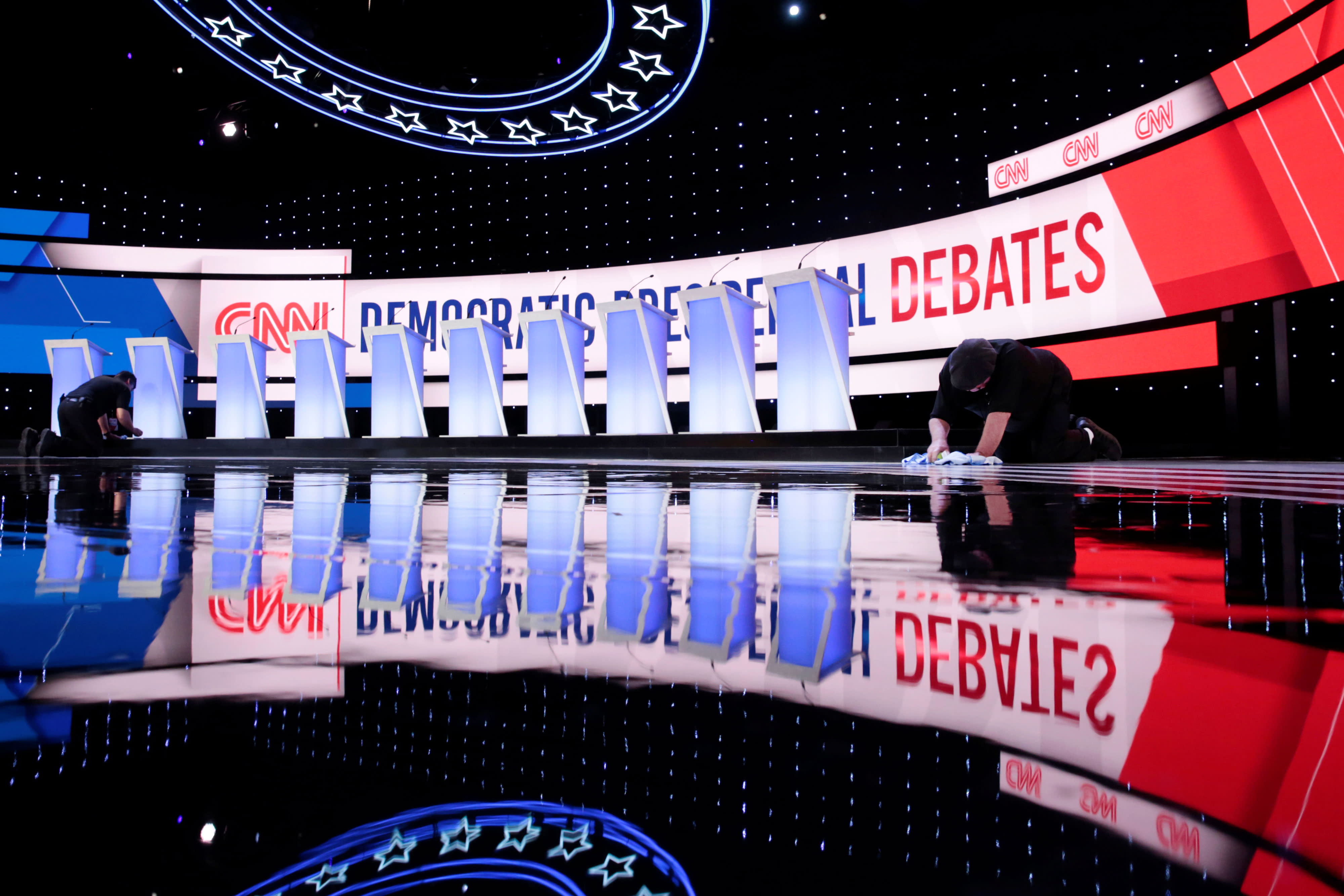

Democratic presidential hopeful former US Representative for Maryland's 6th congressional district John Delaney (C) speaks flanked by former Governor of Colorado John Hickenlooper (L) and Governor of Montana Steve Bullock during the first round of the second Democratic primary debate of the 2020 presidential campaign season hosted by CNN at the Fox Theatre in Detroit, Michigan on July 30, 2019.

Brendan Smialowski | AFP | Getty Images

Little-known former Maryland Rep. John Delaney was the surprising tone-setter during the first night of the second Democratic debates on Tuesday. He picked fights with progressive Sens. Bernie Sanders and Elizabeth Warren, and emerged as the leading moderate voice on the stage in the absence of front-runner Joe Biden.

Delaney spoke for less time than six of the 10 candidates, for a total under 11 minutes, according to a tally by debate host CNN. But according to Google, an hour into the debate he received the biggest boost in total searches via the platform. Google said that searches for the candidate increased 3,400%.

The spats between Delaney and Warren in particular were among the most heated confrontations of the evening, highlighting the wedges that divide the Democratic Party on issues like health care and trade.

In one particularly testy exchange with Warren, Delaney said "Democrats win when we run on real solutions, not impossible promises. When we run on things that are workable, not fairy tale economics."

Warren responded incredulously.

"I don't understand why anybody goes to all the trouble of running for president of the united states just to talk about what we really can't do and shouldn't fight for. I don't get it," Warren said.

The absence Biden on Tuesday provided a vacuum for Delaney to fill in an attempt to gain name recognition and air time, crucial commodities in the crowded field of candidates that is expected to soon be winnowed down. Biden will participate in Wednesday night's debate.

It's not clear whether the confrontational debate stance Delaney took will deliver him new support, however.

The first Democrat to enter the primary contest, the millionaire former CEO has yet to gain traction among voters despite prolific personal spending on his own campaign. He was one of the six candidates on stage on Tuesday who fell below 2%, the threshold set by the Democratic National Committee for admittance to the third debates scheduled for September.

But while many of the low-polling candidates sought to pick fights with the front-runners, Delaney seemed to be the only moderate to consistently draw Warren and Sanders into extended disputes.

In a back-and-forth on trade, Delaney said that under Warren's proposal to change the way that the U.S. negotiates trade deals, announced Monday, "we would not be able to trade with the United Kingdom. We would not be able to trade with the EU. It is so extreme that it will isolate the American economy from the rest of the world."

Warren retorted: "What the congressman is describing as extreme is having deals that are negotiated by American workers for American workers."

Some of the sharpest differences were apparent on health care, the top issue among Democratic voters. Delaney has sought, so far in vain, to make a name for himself as the pragmatic alternative to Medicare for All, the sweeping overhaul proposed by Sanders and supported by Warren and other progressives.

"I'm the only person on stage who understands the business," Delaney, who formerly worked in health-care finance, said at one point.

At another point in the debate, he said of Medicare for All, "I've done the math and it doesn't add up."

"Maybe you did that and made money off of health care, but our job is to run a non-profit health-care system," Sanders responded.

"Kami bertahan dalam hal ini tetapi tubuh kami masih menderita karenanya. Mengerikan hidup di bawah kondisi kualitas udara yang buruk,"

Singapura masih menjadi negara dengan investasi terbesar di Indonesia pada periode tersebut. Jepang Menggeser China.

Lihat liputan lengkap di Google BeritaSingapura masih menjadi negara dengan investasi terbesar di Indonesia pada periode tersebut. Jepang Menggeser China.

Lihat liputan lengkap di Google Berita

Chinese Vice Premier Liu He (R) with United States Trade Representative Robert Lighthizer (2nd L) and Treasury Secretary Steve Mnuchin (L) before the start of talks at the Xijiao Conference Center in Shanghai on July 31, 2019.

Ng Han Guan | AFP | Getty Images

U.S. Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin shook hands with Chinese Vice Premier Liu He before beginning trade talks in Shanghai on Wednesday in a bid to end a year-long trade war.

U.S. President Donald Trump on Tuesday warned China against waiting out his first term to finalize any trade deal, saying if he wins re-election in the November 2020 U.S. presidential contest, the outcome will be worse for China.

South Bend Mayor Pete Buttigieg participates in the first of two Democratic presidential primary debates hosted by CNN Tuesday, July 30, 2019, at the Fox Theatre in Detroit.

Paul Sancya | AP

Gun control emerged as a big issue during the Democratic presidential debate Tuesday in Detroit, but then it grew into an argument about money in politics.

The National Rifle Association, candidates argued, was emblematic of how large, well-funded lobbying groups and corporations exert too much influence on elections.

Sen. Bernie Sanders, who, along with Sen. Elizabeth Warren, was the top-polling candidate on the stage, touted his poor ratings from the NRA as proof of his ability to effect major change.

"Nobody up here is going to tell you that we have a magical solution to the crisis," Sanders said. "I have a 'D-' voting record from the NRA. And as president, I suspect it will be an 'F' record."

Gov. Steve Bullock, who hadn't qualified for the first debate in June, railed against lobbying efforts in his home state of Montana and praised his government's ability to limit corporate spending.

"You can make changes, even in Montana with a two-thirds Republican legislature," Bullock said. "Even we stopped the Koch brothers from spending at that time. If we can kick the Koch brothers out of Montana, we can do it in DC, we can do it everywhere."

South Bend, Indiana, Mayor Pete Buttigieg, who noted he was a member of the first "school shooting generation," went further, proposing structural changes to political lobbying.

"Still the conversation that we've been having for the last 20 years. Of course we need to get money out of politics," Buttgieg said. "Does anyone really think we're going to overtake Citizens United without constitutional action?"

Buttigieg was a high school student when the Columbine massacre occurred in 1999.

The debate came in the wake of the deadly shooting in Gilroy, California, on Sunday night that left three dead and 12 injured.

Marianne Williamson lashed out not only against the NRA but also at candidates who have taken donations from a variety of corporations.

"For politicians, including my fellow candidates who themselves have taken tens of thousands and in some cases, hundreds of thousands of dollars from these same corporate donors, to think that they now have the moral authority to say 'we're going to take them on,' I don't think the Democratic Party should be surprised that so many Americans believe 'yada yada yada,'" she said.

Singapura masih menjadi negara dengan investasi terbesar di Indonesia pada periode tersebut. Jepang Menggeser China Halaman all.

Lihat liputan lengkap di Google BeritaSingapura masih menjadi negara dengan investasi terbesar di Indonesia pada periode tersebut. Jepang Menggeser China.

Lihat liputan lengkap di Google BeritaSingapura masih menjadi negara dengan investasi terbesar di Indonesia pada periode tersebut. Jepang Menggeser China Halaman all.

Lihat liputan lengkap di Google Berita

Senator Bernie Sanders and U.S. Senator Elizabeth Warren shake hands before the start of the first night of the second 2020 Democratic U.S. presidential debate in Detroit, Michigan, July 30, 2019.

Lucas Jackson | Reuters

Progressive Sens. Bernie Sanders and Elizabeth Warren fended off attacks from moderate rivals over Medicare for All in the first night of the second Democratic presidential debates on Tuesday.

The two candidates, standing next to each other at center stage, rebuffed criticism from lesser-known rivals who sought to poke holes in the health-care overhaul.

The two senators agree broadly on policy but are likely each other's strongest obstacle to the Democratic nomination. On Tuesday, the lawmakers demonstrated a united front.

The most pointed attacks came from former Maryland Rep. John Delaney, who has previously said that the proposal amounted to "political suicide." Delaney resumed that attack Tuesday, and accused Warren and Sanders of "telling half the country that their health insurance is illegal."

"You're wrong," Sanders told him. "Five minutes away from here, John, is a country. It's called Canada. They guarantee health care to every man, woman, and child as a human right. They spend half of what we spend. And by the way when you end up in a hospital in Canada you come out with no bill at all."

"We are not trying to take away health care from anyone," Warren said. "That's what the Republicans are trying to do. And we should stop using Republican talking points in order to talk with each other about how to best provide that health care."

Other candidates also piled in, including author Marianne Williamson, Ohio Rep. Tim Ryan, Montana Gov. Steve Bullock former Colorado Gov. John Hickenlooper and Sen. Amy Klobuchar of Minnesota.

Williamson said she was "normally way over there" with Sanders and Warren, but pushed back on the notion that criticism of Medicare for All amounted to repeating Republican talking points.

"On this one, I hear the others. And I have some concern about that as well. And I do have concern about what the Republicans would say," Williamson said. "And that's not just a Republican talking point. I do have concern that it will be difficult. I do have concern that it will make it harder to win. And I have a concern that it will make it harder to govern."

Ryan and Sanders feuded over whether union members would get better health care under Medicare for All versus with the health-care plans negotiated by their unions. Sanders said Medicare for All would provide better care, but Ryan said Sanders couldn't know that.

"I do know it. I wrote the damn bill," Sanders said.

Bullock, who did not meet the cut-off for the first debates in Miami last month, called the plan "an example of wishlist economics."

"We can get there with a public option, negotiated drug prices," he said.

"I share their progressive values, but I'm a little more pragmatic," said Hickenlooper. "It would be an evolution, not a revolution."

"I just have a better way to do this," Klobuchar said.

At times, the attacks grew personal. Delaney pushed hardest — and drew the hardest rebuke from Sanders.

"I've done the math and it doesn't add up," Delaney, a former businessman who founded a health-care finance company, told Sanders.

"Maybe you did that and made money off of health care, but our job is to run a non-profit health-care system," Sanders responded.

Bisnis.com, JAKARTA— Kamar Dagang dan Industri Indonesia berencana untuk menghubungkan pelaku usaha Usaha Mikro Kecil dan Menengah (UMKM) di ...

מתברר כי ישנם אוהדים רבים לאופרה באשדוד: במוצ״ש, נערכה במשכן לאמנויות הבמה האופרה 'ריגולטו' בהשתתפות זמרי אופרה מרחבי העולם והתזמורת הסימפונית אשדוד. האופרה ...

Simone Marchetti wears Apple AirPods during Milan Fashion Week in Milan, Italy.

Melodie Jeng | Getty Images

Apple is often referred to as the "iPhone company," because that's the product that's driven the majority of Apple's sales for years.

Since 2012, the iPhone has accounted for over half of Apple's revenue for every single quarter. But that streak broke when Apple reported earnings on Tuesday — instead, Apple's biggest product only accounted for 48% of total sales, and iPhone sales were actually down 12% from last year.

Yet Apple beat expectations and total revenue was up from a year ago.

The main product category picking up the slack? What Apple calls "wearables" — the category including Apple Watch, AirPods wireless earbuds, and Beats headphones.

Apple CEO Tim Cook called it a "blowout quarter" for its wearables product category and said there was "phenomenal demand" for the $159 AirPods.

Apple said that Wearables, Home and Accessories sales totaled $5.53 billion in the most recent quarter, which was a massive beat — analysts surveyed by FactSet were only expecting sales of $4.59 billion, nearly a billion less than the actual number.

It's hard to do a year-over-year comparison, because Apple rearranged its product categories late last year, but Apple Watch and headphones used to be in a category called "Other Products," which totaled $3.7 billion in the same period last year.

"As I mentioned at the outset, it was another sensational quarter for Wearables, with growth accelerating to well over 50 percent," Cook said in a call with analysts to discuss the company's results.

Apple doesn't break out unit sales anymore, and never did for products like Apple Watch, so it's unclear eactly which products are driving the growth, but Cook said that wearables by itself — not accessories — was up "well over" 50% and was the size of a Fortune 200 company over the last 12 months. (The 200th company on the Fortune 500 is General Mills, with $15.74 billion in revenue last year.)

Perhaps the biggest positive for Apple's growth going forward is that competition is less fierce in the smartwatch and wireless earbud categories than in smartphones.

In the fourth quarter of 2018, the last quarter which estimates are available, Apple was by far the number one wearables company by unit shipments, according to IDC data, with 16.2 million units shipped.

Next was Xiaomi, with 7.5 million units, primarily shipped to China.

"We've got the wearables area that is doing extremely well," Cook said in response to a question about the future of Apple aside from the iPhone. "We stuck with that when others perhaps didn't, and really put a lot of energy into this and a lot of R&D, and are are in a very good position today to keep playing out what's next there."

A man using an angle grinder on a steel piece at a metal fabrication company on August 7, 2018 in Orange County, New York.

Waring Abbott | Getty Images

The world's largest steel corporations are not reducing emissions at the rate required to keep global warming below 2 degrees Celsius, a failure that on average puts 14% of the companies' potential value at risk, according to a new analysis of corporate earnings profiles.

The 20 companies, which together represent 30% of global steel production, are currently expected to reduce emissions by less than 50% by 2050, falling behind the 65% reduction standard set by the International Energy Agency.

"Steel represents the most emissions-intensive industry — it's a huge footprint," said Luke Fletcher, a senior analyst at CDP, the international nonprofit that wrote the new report and works with companies to disclose financial risks of climate change on their bottom line.

The report illustrates the failure of polluting corporations to keep up with climate regulations and the financial losses they could suffer as carbon prices rise and the planet warms.

For decades, the steel sector has produced essential metal for construction, cars and food cans. However, it's also responsible for 7% to 9% of all direct fossil fuel emissions, according to the World Steel Association, and is currently the largest industrial source of climate pollution.

Under a 2 degrees Celsius scenario where global carbon prices rise to $100 per metric ton by 2040, the companies on average face a 14% hit risk, ranging from 2.5% to 30% for individual companies, the report shows.

Leaders at the World Bank and International Monetary Fund have pushed governments to implement higher prices on carbon in order to force fossil fuel polluters to pay for the carbon dioxide they emit into the atmosphere. Cutting emissions alone, they say, is not enough to effectively combat climate change.

The EU's carbon price, for instance, has more than tripled since 2018 and is expected to rise in upcoming years. ArcelorMittal, a multinational steel corporation headquartered in Luxembourg City, cited higher carbon prices in its decision to slash production in May.

Steel companies are not on track to reduce emissions or avoid financial losses from higher carbon prices. According to the report, while 60% of the companies have set emissions reduction targets, only two of them are aligned with a 2 degrees Celsius or below emissions target.

Those companies are SSAB, a Nordic- and U.S.-based steel company that aims to reach carbon neutrality by 2045, and South Korea-based Hyundai Steel, which aims for an 80% reduction in emissions by 2050.

"The pace at which the steel sector is reducing emissions is too slow for the transition to a low-carbon economy," Fletcher said, "and it needs to deploy and commercialize radical technologies if it is to avoid looming carbon costs and remain competitive."

There is also a geographic gap between higher and lower performing companies. The report showed that Chinese, Russian and U.S. companies lagged behind European and East Asian companies in developing low-carbon technologies.

"A lot of these regions don't have stringent carbon pricing regulations," Fletcher said.

"We found across the board that the companies doing well were setting ambitions and goals to reduce their emissions, looking toward the long term and embracing innovation."

Some steel plants are working on steelmaking technology that would reduce carbon dioxide emissions and energy consumption, such as hydrogen steelmaking and electrolysis using clean electricity.

SSAB, for instance, is developing green hydrogen steelmaking technologies. ArcelorMittal is working on technology that uses electricity to reduce iron oxides, as well as technology that separates carbon dioxide from waste gases.

However, innovative technology couldn't be implemented commercially until the 2030s and would raise the cost of steel production by 20% to 30%. Higher production costs could be a disincentive for companies to embrace new technologies, Fletcher said.

Still, more technologies to reduce carbon emissions are emerging, and the sector has also become a leader in recycling, as steel is now the world's most recycled material.

"Companies are aware of the risks that these carbon costs represent, and they can reduce these risks by embracing cleaner technology and looking at their earnings profiles," Fletcher said.

A South Korean flag, left, and Samsung Electronics Co. flag fly outside the company's headquarters in Seoul, South Korea.

Jean Chung| Bloomberg | Getty Images

Samsung Electronics said Wednesday that profits for the three months that ended June more than halved from a year earlier due to falling memory chip prices.

Operating profit for the quarter came in at 6.6 trillion Korean won ($5.6 billion), the world's largest smartphone maker said. Its consolidated revenue was at 56.13 trillion won.

"The weakness and price declines in the memory chip market persisted as effects of inventory adjustments by major datacenter customers in the previous quarters continued, despite a limited recovery in demand," Samsung said in a news release.

Those numbers were slightly better than the guidance the company provided earlier this month.

Samsung said its semiconductor business posted consolidated revenue of 16.09 trillion won and an operating profit of 3.4 trillion won for the quarter. The company said its memory unit saw increased demand despite weak market conditions. For the second half of the year, Samsung said, "demand is expected to grow although the Company sees volatility in the overall industry due to increased external uncertainties."

Memory components, which are used in mobile handsets and enterprise servers, make up Samsung's main profit-making business.

This is the second consecutive quarter where the South Korean tech giant's operating profit more than halved from the same period a year earlier. In the three months that ended March, Samsung's profits fell about 60% on-year to 6.2 trillion Korean won ($5.3 billion).

The global semiconductor industry is undergoing a period of inventory adjustment that is keeping demand low and causing a supply glut, which is squeezing prices. Analysts have said they expect a recovery to get underway in 2020.

Last week, Samsung rival SK Hynix reported its smallest quarterly earnings in three years, missing an industry estimate.

South Korean chipmakers have another cause for concern: An ongoing dispute between Japan and South Korea resulted in Tokyo restricting exports of crucial high-tech materials that are used by the likes of Samsung and SK Hynix to make chips and smartphone displays.

While the short-term impact of the restriction is expected to be limited due to high inventory levels, analysts have said companies may face longer term difficulties in sourcing for alternatives. While that could potentially help push up chip prices, it is likely to make smartphones and other electronics more expensive.

— Reuters contributed to this report.

Pembukaan markas kedua di Jakarta ini akan segera dilakukan setelah dana investasi dari perusahaan pendanaan asal Jepang, Softbank, cair.

BANDUNG WETAN, AYOBANDUNG.COM -- Kepala Dinas Tenaga Kerja dan Transmigrasi (Disnakertrans) Jabar, M. Ade Afriandi mengatakan, kenaikan Upah ...

Ada ternyata para pendiri yang justru diusir dari perusahaan miliknya.

צילום: דני מרון | צילום: ספורט 5. "איך אפשר להצליח כשאתה לא מקבל הזדמנויות?" עזרא (דני מרון) | צילום: ספורט 5. אם הייתם מספרים לחן עזרא לפני שנה שבקיץ 2019 הוא ימצא את ...

Airwallex's cofounders, from left to right, Xijing Dai, Lucy Liu, Jack Zhang and Max Li.

Airwallex

When Jack Zhang and Max Li were looking for a side-hustle to supplement their day jobs, they did like good Melbournites and opened a coffee shop.

It seemed like an easy choice for two Chinese natives keen to assimilate into one of the coffee capitals of the world.

Easy it was not. However, it did brew an idea which would go on to become the fastest-growing $1 billion start-up in Australia's history.

Zhang and Li are co-founders of Airwallex, an international payments platform which in three short years has achieved the much-coveted unicorn status.

The idea for the low-cost, cross-border fintech company — think Transferwise for businesses — hit the pair after seeing the exorbitant fees charged by traditional banks when they wanted to import coffee cups from overseas.

So, they teamed up with college friends Lucy Liu, Xijing Dai and Ki-Lok Wong to come up with a solution.

Airwallex co-founder Lucy Liu.

Airwallex

"They were importing a lot from China and they found the whole process to be very painful," Liu told CNBC Make It in Hong Kong.

And if it was painful for them, they were willing to bet it was painful for other small business owners, too.

"We thought there must be something we could do," continued Liu, who, until that point in 2015, had been working in Melbourne as an investment banker.

We didn't have a lot of time to think about what ifs.

Lucy Liu

co-founder, Airwallex

So, within months, the young friends quit their jobs and set to work combining their various expertise in software engineering, finance and architecture to build a "system for the companies of the future."

"We just had to take a leap of faith," said Liu, now 28 and also originally from China.

"We didn't have a lot of time to think about what ifs," she added, noting the competitiveness of the payments market at that time.

The system the group launched in 2016 allows users to set up overseas bank accounts for paying customers based in other countries. When users are ready to move that revenue back to their HQ, they can transfer it through the Airwallex system, which uses mid-market rates.

That can reduce costs for users by as much as 90% based on traditional foreign exchange rates, according to the company, resulting in fees of less than 1%.

Airwallex's Melbourne headquarters.

Airwallex

Having invested a combined $1 million of their own savings and those of friends and families to get the project off the ground, Airwallex quickly attracted a slew of investments from high profile backers including Sequoia Capital, Tencent and Horizons Ventures.

The company's latest $100 million funding round, which was led in March by DST Global, an early investor in Airbnb and Spotify, valued the company above $1 billion — a feat never before achieved so quickly in Australia.

That round closed in less than two months and took the five founders' estimated wealth to more than $100 million each.

There's really not one platform that's dominating Asia, " said Liu. "That's our selling point.

Lucy Liu

co-founder, Airwallex

Airwallex's Melbourne headquarters.

Airwallex

The Anadarko Petroleum logo is seen on the hard hat of a contractor at the company's oil rig site in Fort Lupton, Colorado.

Jamie Schwaberow | Bloomberg | Getty Images

Anadarko Petroleum on Monday released new financial details of its proposed combination with Occidental Petroleum that revealed its acquirer did not expect to generate enough cash to cover its shareholder payments until 2022.

Activist investor Carl Icahn this month launched a campaign to unseat four Occidental directors, arguing its board entered into the $38 billion deal to preclude Occidental from becoming a takeover target. He has attacked the deal as too pricey and for the lack of an Occidental shareholder vote.

Anadarko said in a regulatory filing it amended its merger proxy in response to a lawsuit alleging it had failed to provide its shareholders with full details of the cash-and-stock sale. Its shareholders are due to vote on the sale Aug. 8.

An Anadarko spokesman did not immediately reply to requests for comment.

The revisions include projections that the filing said was provided by Occidental's management and adjusted by Anadarko's executives showing the standalone company's free cash flow would fall below dividend payments in each of the next three years. The shortfall increased each year through 2021, according to the proxy revision.

Companies that do not generate enough free cash flow to cover expenses such as dividends typically have to borrow or sell assets to cover the shortfall.

The new details also include an $8.4 billion estimate of the value of Anadarko's share in Western Gas Partners, a publicly-traded natural gas processing, storage and pipeline company. That stake is expected to be offered for sale after the combination takes place.

הזמר שעורר סערות העלה סרטון לרשתות החברתיות בו הוא רומז על פרישה • "כבר יצאו לי הבננה מהחורים" • פרובוקציה נוספת או מהלך אמיתי?

Kepala Bappenas Bambang Brodjonegoro mengatakan Jokowi sedang gelisah dengan daerah karena belum terbuka dalam pemberian kemudahan izin ...

Harga minyak kelapa sawit mentah (Crude Palm Oil/CPO) membukukan koreksi pada hari ini.

Steel Pipe Industry (ISSP) ini mencatatkan pendapatan Rp 2,29 triliun di semester I 2019.

In this photo illustration a Grindr logo is seen displayed on a smartphone on April 01, 2019.

Rafael Henrique | LightRocket | Getty Images

Chinese gaming company Beijing Kunlun Tech said on Monday it would revive plans for an initial public offering (IPO) of popular gay dating app Grindr, after a U.S. national security panel dropped its opposition to the plan.

Kunlun said in May it had agreed to a request by the Committee on Foreign Investment in the United States (CFIUS) to sell Grindr, setting a June 2020 deadline to do so and putting preparations for an IPO of Grindr on hold.

A source familiar with the matter said on Monday that Kunlun's efforts to sell Grindr outright were continuing even as the IPO preparations were relaunched.

A Grindr spokeswoman declined to share more information about the IPO plans. Kunlun did not respond to requests for comment. The U.S Treasury Department, which chairs CFIUS, did not immediately respond to a request for comment.

CFIUS has not disclosed its concerns about Kunlun's ownership of Grindr. However, the United States has been increasingly scrutinizing app developers over the safety of personal data they handle, especially if some of it involves U.S. military or intelligence personnel.

Reuters reported in May that Kunlun had given some Beijing-based engineers access to the personal information of millions of Americans, including private messages and HIV status.

Kunlun said in May it would shut down Grindr's China operations and would not send any sensitive user data to China, in an effort to address concerns over data privacy.

Grindr will be listed on a stock exchange outside China, with the timing of the move to be decided according to overseas capital market conditions, Kunlun said in a filing to the Shenzhen stock exchange on Monday.

Kunlun is one of China's largest mobile gaming companies. It acquired a majority stake in Grindr in 2016 for $93 million and bought out the remainder of the company in 2018. It did so without submitting the transactions for CFIUS review.

Kunlun's control of Grindr has fueled concerns among privacy advocates in the United States. Democratic U.S. Senators Edward Markey and Richard Blumenthal sent a letter to Grindr last year demanding answers about how the app would protect users' privacy under its Chinese owner.

Freefloat Tinggi Tak Jadi Jaminan Saham Menarik.

BEIJING - Amerika Serikat (AS) mengirimkan beberapa juta ton kedelai ke China sejak pemimpin kedua negara bertemu pada Juni. Perang dagang AS dan ...

Harga minyak kelapa sawit mentah (Crude Palm Oil/CPO) membukukan koreksi pada hari ini.

צילום: דני מרון | צילום: ספורט 5. "איך אפשר להצליח כשאתה לא מקבל הזדמנויות?" עזרא (דני מרון) | צילום: ספורט 5. אם הייתם מספרים לחן עזרא לפני שנה שבקיץ 2019 הוא ימצא את ...

חצי שנה אחרי שכבש את הצופים ועשה את דרכו עד לשלב חצי הגמר של "הכוכב הבא לאירוויזיון", דניאל ברזילאי חוזר עם סינגל ראשון מתוך האלבום שבדרך. את "עד שתמצאי" הוא כתב ...

Worries about the U.S.-China trade war are running high during the current U.S. quarterly reporting season, with companies as diverse as Juniper Networks and O'Reilly Automotive bemoaning the consequences but saying they are finding ways to weather the storm.

Trade negotiations shift to Shanghai on Tuesday, with stock market investors sensitive to fallout from the year-long conflict and any signs that it could escalate.

Tariffs were mentioned in about a third of conference calls held by S&P 500 companies reporting their quarterly results through July 26, according to FactSet.

The 71 firms flagging tariffs were up from the 50 companies discussing tariffs in the same time frame in the first-quarter season, but less than the 99 a year ago when tariffs were an emerging issue for U.S. corporations.

Many of those corporations outlined to investors their plans to minimize the impact of the trade war, which has added to uncertainty as they struggle with a sluggish global economy, including lackluster economies in Europe and Japan.

Parts supplier O'Reilly Automotive said in its conference call last week that it raised the prices of its products to make up for higher costs related to the tariffs.

Network gear maker Juniper Networks on Thursday missed the mid-point of its margin guidance due to the tariffs, saying it expected pressure to continue, even as it manages its operating expenses to mitigate the damage.

Of S&P 500 components that have reported their second-quarter earnings, export-focused companies have beaten analysts' expectations 77% of the time, while companies focused on the domestic economy have exceeded expectations just 66% of the time, according to an analysis by Credit Suisse.

That suggests that export-oriented companies are feeling the trade war less than investors expected, said Patrick Palfrey, an earnings analyst at Credit Suisse.

"Trade is an exacerbating factor, as opposed to the primary driver of the slowdown," Palfrey said.

S&P 500 earnings are expected to have risen just 0.6% in the second quarter from a year ago, according to IBES data from Refinitiv. A big part of the slowdown reflects tough comparisons with a year ago, when the U.S. tax cut package led to a 24.9% jump in second-quarter earnings.

Roughly 76% of the 222 companies that have reported as of Monday morning have beaten analysts' earnings expectations, in line with the recent trend.

Third-quarter earnings expectations have now turned negative, however, with earnings expected to decline 0.6% from a year ago, based on Refinitiv's data.

Wall Street has reacted sharply over the past year to tweets from U.S. President Donald Trump, variously suggesting progress and setbacks in settling the trade dispute.

Buoyed by expectations the Federal Reserve will cut interest rates, but also suggesting investors are becoming less sensitive to uncertainty around the trade war, the S&P 500 has surged 20% year to date and hit record highs last week.

Mattel's stock has surged 16% since Thursday, when the toymaker's quarterly results beat expectations, while it warned about the impact of an escalation of the trade war.

"We are being watchful of the potential tariff that may be implemented, and if implemented, would impact the entire toy industry. We have contingency plans in place and we're working closely with the retailers to ensure that we are aligned on our approach to mitigate the tariffs," Mattel CEO Ynon Kreiz said on a conference call last week.

The Philadelphia Semiconductor index has surged 38% in 2019, even as trade tensions and U.S. restrictions on sales to Chinese telecom Huawei make it harder to predict when U.S. chipmakers will recover from a global, cyclical downturn.

Investors were surprised last week after Texas Instruments said that U.S.-China trade tensions were not hampering its ability to conduct business in China, while Intel said on Thursday that customers worried about potential tariffs on chips were preemptively buying processors.

"We really think the Q2 action was pulling from the second half into the first half," Intel CFO George Davis told Reuters following the earnings report. "Depending on how the trade discussions go, there could be some additional activity there, but we're not expecting at the same level, if at all, during the third quarter. We're forecasting demand based on the signals we're getting from our customers."

China recently signaled it would allow Chinese firms to make some tariff-free purchases of U.S. farm goods, while Washington has encouraged companies to apply for waivers to a national security ban on sales to Huawei. But going into the talks, neither side has implemented the measures that were intended to show their goodwill.

from Top News & Analysis https://ift.tt/2GD2WyC