Trade relations between China and the U.S. overshadow most everything as stocks enter the month of December, but in the week ahead the Fed and U.S. economy come back into play with important Fed testimony and the November employment report.

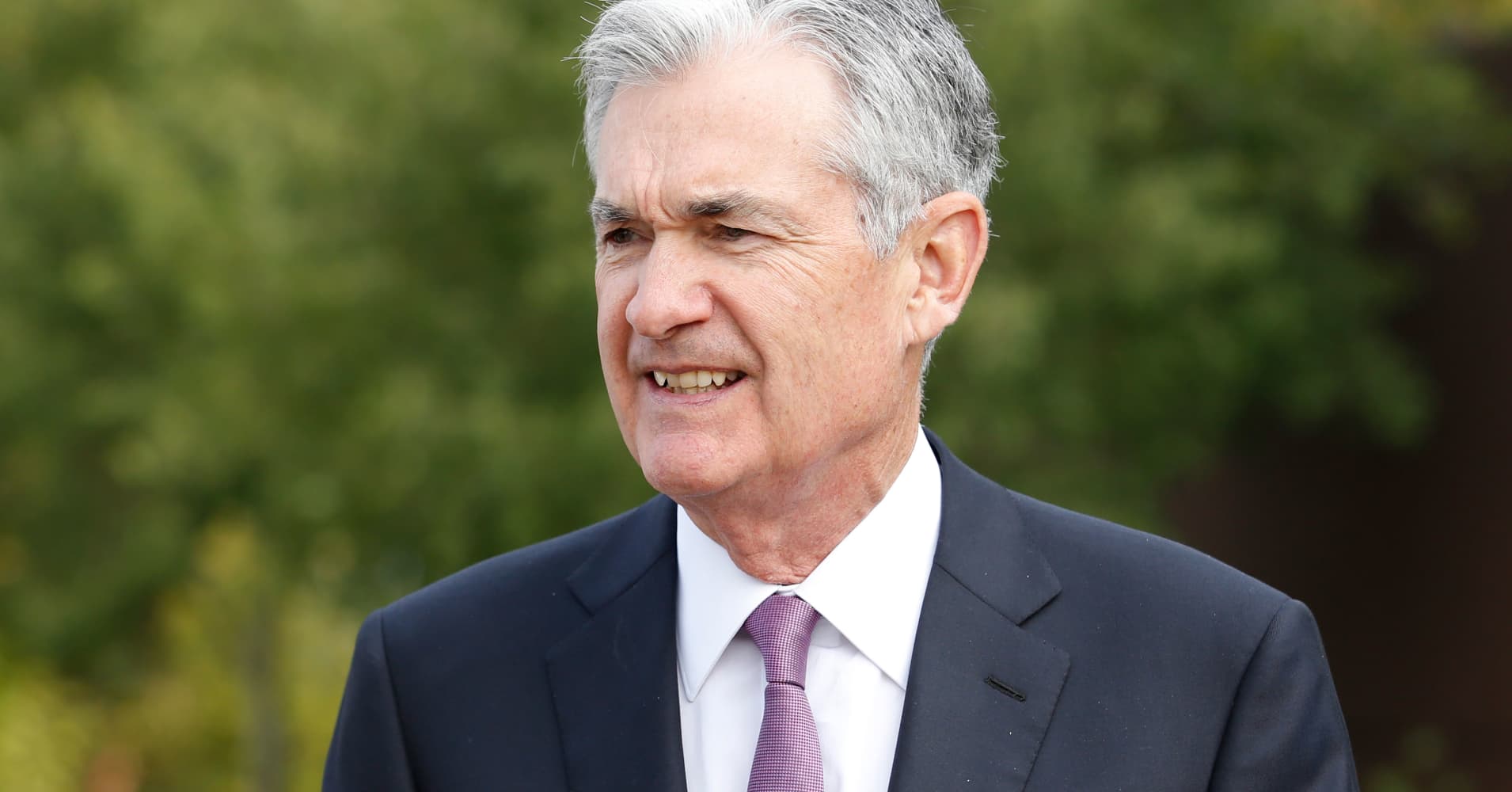

Fed Chairman Jerome Powell, whokicked off a powerful rally with his comments Wednesday, appears before the Joint Economic Committee of Congress this coming Wednesday to speak on the economy. Powell said the Fed was close to the neutral rate, the level on the benchmark fed funds rate that is neither stimulative nor slowing for the economy.

That comment sparked a rally of more than 600 points in the Dow and, in the market's view, reversed a previous comment from Powell that neutral was far off, meaning the Fed would have to keep hiking interest rates aggressively. The market is now pricing in one hike for December and just one for all of 2019.

"I think the markets may have overemphasized the dovishness of what he's trying to say," said Scott Anderson, chief economist at Bank of the West. "I think [the Fed] is trying to wean the markets off of forward guidance. …They want to give themselves a little flexibility." Anderson said there's risk the first half of 2019 could be weaker, and he does expect the economy to slow just below 2 percent in the second half, in part due to trade wars.

He said Powell's comment makes the Fed's interest rate forecast all the more important when it is released after the next meeting on Dec. 19. The Fed currently has forecast three interest rate hikes for next year, but the market is concerned the economy will not support that many. Powell's comments before Congress in the week ahead are also important, given the fact he was criticized by President Donald Trump for raising interest rates.

"It's kind of dicey politically, I think, and the fact his statement just a month ago was interpreted so hawkishly," said Anderson. Economists expect Powell to state that the Fed is independent and point to the fact that it is dependent on data for rate guidance.

Although the stock market rallied on Powell's statement and bond yields fell, some economists believe the markets misinterpreted the Fed's message. Both J.P. Morgan and Goldman Sachs economists expect four rate hikes next year.

The emphasis in the week ahead will also be on any U.S. data that can help steer the Fed. Most important is Friday's employment report, but there are also vehicle sales and ISM manufacturing data Monday.

Economists expect 200,000 jobs were created in November, and wages grew at a pace of 3.1 percent year over year. Vehicle sales will also be important, especially after GM's announced layoffs, and economists are expecting to see sales on an annualized basis at 17.2 million, down from the 17.6 million reported in October.

OPEC meets Thursday, and analysts expect Saudi Arabia and Russia to steer the group to a production cut, with Saudi Arabia bearing most of it. Oil prices fell more than 20 percent in November, their worst month since October 2008.

"Our base scenario is you might get some sort of actual but gradual and not really telegraphed 1 million barrels a day cut," said Citigroup energy analyst Eric Lee.

West Texas Intermediate crude futures lost 22 percent in November and closed down 1 percent Friday at $50.93 per barrel.

Stocks staged a stunning turnaround in the past week, erasing losses for an otherwise rough month of November. The S&P 500 was up 4.8 percent to 2,760 for the week and is now just a point below the key 200-day moving average. The S&P was up 1.8 percent for the month of November.

Stocks rallied on Powell but also on optimism for a trade truce between the U.S. and China when Trump and Chinese President Xi Jinping were to meet Saturday.

"Is the market pricing in a cease-fire?" asked Scott Redler, partner with T3Live.com. He said the market could have gotten ahead of itself, depending on the outcome of the trade meeting between Trump and Xi. "We just had our biggest weekly move since 2011. Is that taking away from the actual event? I think the market has priced in about 75 percent of a cease-fire."

Redler said the next area of resistance is around 2,810, if stocks continue to gain after the weekend meeting.

Stock traders may also be watching the bond market,after the 10-year Treasury yield fell to 2.99, just below the 3 percent level. The yield, which moves opposite price, moved closer to the yield of the 2-year, in a flattening move. With the 2-year at 2.78, the difference was just 21 basis points.

Traders believe that occurs when the market is warning about the strength of the economy. If the yield inverts and the 10-year drops below the 2-year, it is a fairly reliable recession warning.

Monday

Earnings: Coupa Software, Mesa Air, Smartsheet

Monthly vehicle sales

8:00 a.m. Fed Vice Chairman Randal Quarles

9:15 a.m. New York Fed President John Williams

9:45 a.m. Manufacturing PMI

10:00 a.m. ISM manufacturing

10:00 a.m. Construction spending

10:30 a.m. Fed Governor Lael Brainard

12:00 p.m. Dallas Fed President Rob Kaplan

Tuesday

Earnings: Hewlett Packard Enterprises, AutoZone, Toll Brothers, HD Supply Holdings, Donaldson, Bank of Montreal, Dollar General, Guidewire Software, Marvell Tech

10:00 a.m. QFR

Wednesday

Earnings: H&R Block, Lululemon Athletica, Brown-Forman, American Eagle Outfitters, Lands' End, Korn/Ferry, Cloudera, Five Below

8:15 a.m. ADP employment

8:30 a.m. Productivity and costs

9:45 a.m. Services PMI

10:15 a.m. Fed Chairman Jerome Powell testimony Joint Economic Commitee

10:00 a.m. ISM nonmanufacturing

2:00 p.m. Beige book

8:15 p.m. Fed Vice Chairman Quarles

Thursday

Earnings: Kroger, Michael Cos, Thor Industries, Broadcom, Cooper Cos, Ulta Beauty, Hovnanian, Signet Jewelers, Duluth, American Outdoor Brands, Zumiez

8:30 a.m. Initial claims

8:30 a.m. International trade

10:00 a.m. Factory orders

11:00 a.m. Atlanta Fed President Raphael Bostic

6:30 p.m. New York Fed's Williams

6:30 p.m. Fed Chairman Jerome Powell

Friday

Earnings: Vail Resorts

8:30 a.m. Employment

10:00 a.m. Consumer sentiment

10:00 a.m. Wholesale trade

1:00 p.m. New York Fed's Williams

3:00 p.m. Consumer credit

No comments:

Post a Comment