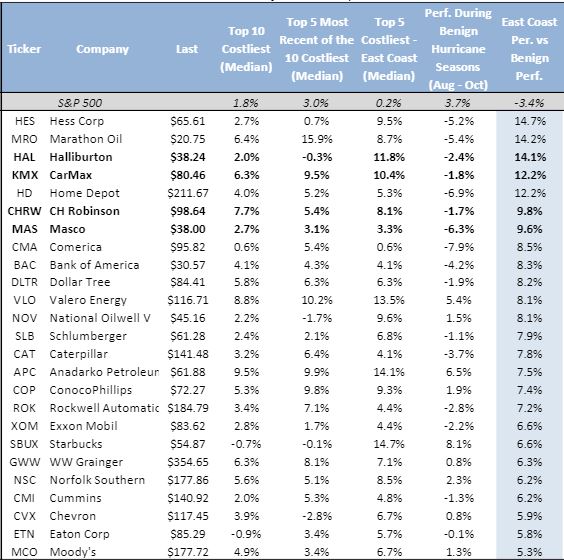

J.P. Morgan derivatives strategists recommended short term option bets on Masco, Carmax, C.H. Robinson, and Haliburton, based on their historic outperformance during post-hurricane rebuilding.

Hurricane Florence is heading toward the coast of the Carolinas and is expected to dump high amounts of rain on the southeast U.S. when it makes landfall Friday. The bank said insured loss estimates are in the $8 to $20 billion range, which would put it among the top 10 most costly storms.

The four stock plays were among the best performers relative to the S&P 500, based on JP Morgan's study of individual companies in the index during major hurricanes going back to 2000. JP Morgan analysts screened S&P companies in energy, industrials, consumer discretionary and staples and the financial sectors to find the 25 stocks that typically outperform in the week before and in the period following major hurricanes.

So far, the analysts said there has been limited reactions in stocks that historically outperform, but there has been clear movement in Home Depot, Haliburton, Schlumberger, Conoco Phillips and Dollar Tree. Home Depot was up 4.1 percent week-to-date Thursday morning, while Schlumberger was up 1.7 percent, Conoco up 1.9 percent and Dollar Tree gained 3.6 percent.

JP Morgan research analysts have longer term neutral ratings on Masco and C.H. Robinson, but the equity strategists recommend plays using October dated options.

Building products company Masco typically benefits from rebuilding, while C.H. Robinson gains on the impact of disruptions in freight and travel, which cause trucking capacity to tighten and spot prices to rise.

Carmax is another company that benefits as flooding typically creates demand for used vehicles. The states of Georgia, South Carolina, North Carolina and Virginia account for 17 percent of Carmax's locations. J.P. Morgan does not have an investment rating on the stock.

The energy sector tends to outperform, and Haliburton tends to outperform its peers. JP Morgan does have an overweight on the stock with a year-end target of $63 per share.

The analysts based their research on the market activity in the week before and in the four weeks following land fall for the top five recent hurricanes— Maria, Harvey, Irma, Sandy and Ike. They also looked at the top five East Coast storms—Irma, Sandy, Ivan, Rita and Frances.

Source: JP Morgan Equity Derivatives Strategy

*Stock range periods one week prior and four weeks following hurricane landfall and dissipation

No comments:

Post a Comment