Warren Buffett

David A. Grogan | CNBC

Berkshire Hathaway chiefs Warren Buffett and Charlie Munger will do their best to answer several hours' worth of questions during the company's annual meeting this Saturday on everything from investing to politics to life.

Despite the fact that most of the 30,000 Berkshire investors congregating in Omaha, Nebraska are lifetime Buffett devotees, many are sure to raise one awkward matter: Why does Berkshire continue to underperform the stock market and what are Buffett, 88, and Munger, 95, going to do to correct course?

Michelle Buckley, Chief Investment Officer of Baldwin Brothers, a Berkshire holder with $1 billion under management, said that while her firm appreciates Berkshire's reliable earnings potential, there is growing concern the conglomerate is being too conservative. Especially with its $110 billion cash hoard in a market environment clearly rewarding increased risk-taking and growth — not exactly Buffett's forte.

"We have owned Berkshire Hathaway at Baldwin for a significant amount of time and continue to incorporate it into our proprietary equity strategies to reflect that legacy positioning but also to capture the conglomerate's earnings potential," Buckley wrote in an email. "We are, however, becoming increasingly uncomfortable with Berkshire, as we also built our position to reflect the conglomerate's historically noteworthy cash conversion and capital allocation."

Baldwin owned 83,000 Berkshire Class B shares at the end of March with a current market value of about $18 million. Baldwin also sponsored a 2017 proposal on Berkshire's proxy ballot to attempt to reduce the conglomerate's methane emissions.

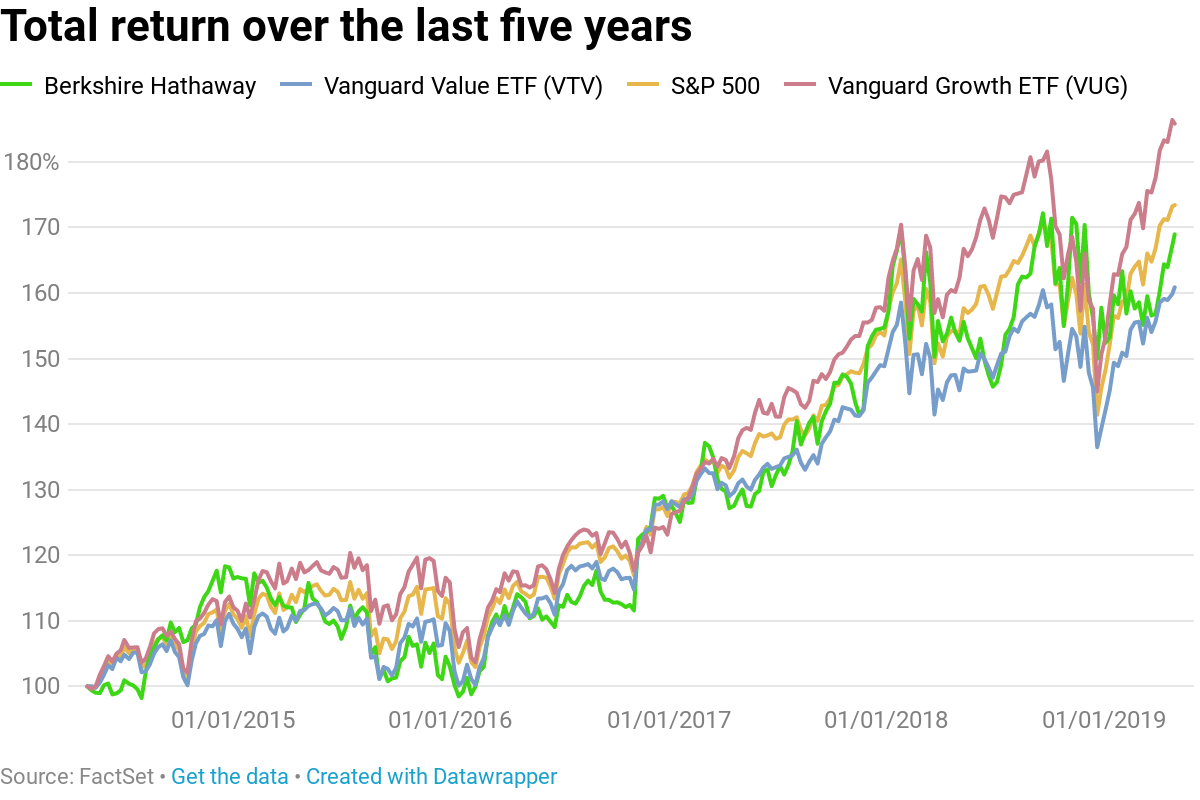

It may surprise some investors to learn that despite Buffett's prowess and mammoth lifetime outperformance, Berkshire is trailing the S&P 500 over the last one, five, 10 and 15 years. To be fair to Buffett, a lot of that is due to stock investors continued preference for hot growth stocks, which the classic value investor has largely avoided. These include names such as Microsoft, Amazon and Alphabet.

Growth equities have seen remarkable outperformance over the broader market over the last five years, with the Vanguard Growth ETF up 185% versus the S&P 500's 173% gain on an indexed basis.

Meanwhile, Berkshire's management team oversees a private portfolio of companies described by the CEO as a "Niagara" of cash generation. And Berkshire has stock holdings in big, value companies like Coca-Cola, Bank of America and Verizon. These types of stocks, Buffett has said, help guarantee earnings for years to come through persistent dividends and stable balance sheets.

But the rest of Wall Street hasn't been interested in hunting for value amid consumer staples companies or big banks, opting instead for flashy acronyms stocks such as the FANGs.

And some of those value names for Buffett have turned into traps, including underperforming bank stocks and Kraft Heinz, one of Berkshire's largest holdings. Stock of the packaged food giant, whose products include Heinz Tomato Ketchup, Jell-O and Kraft Macaroni & Cheese, plunged more than 27% in a single session earlier this year.

Putting the cash to work

If the market preference for these stocks turns — like it did suddenly and briefly in December — Berkshire is likely to shine relative to the market, cementing Buffett's legend status once again. But if things stay on a similar course, Berkshire is unlikely to regain ground on the market anytime soon.

Buffett himself has made hints the market may be getting ahead of itself and has grown agitated by the drought of investment opportunities for adding to his conglomerate. The Berkshire CEO told shareholders in February that steep prices were keeping him on the sidelines.

"2019 will likely see us again expanding our holdings of marketable equities," Buffett wrote earlier this year. "We continue, nevertheless, to hope for an elephant-sized acquisition. Even at our ages of 88 and 95 – I'm the young one – that prospect is what causes my heart and Charlie's to beat faster. "

While some investors may bemoan the wait-and-see approach, Buffett has never been one to overpay, even if it meant holding excess cash for long periods of time. Indeed, Buffett promised in his 2019 shareholder letter than Berkshire "will forever remain a financial fortress" with a minimum of $20 billion on hand in case of a sudden financial downturn.

For lack of a better option, Berkshire's stepped up its efforts to buy back its stock to the tune of about $1.3 billion in 2018, though some investors were disappointed in the smaller-than-expected repurchase.

Berkshire Hathaway's top holdings

To be sure, UBS analyst Brian Meredith told CNBC that those investors fixated on Berkshire's capital deployment aren't giving its current businesses enough credit.

"You still have this massive $100 billion of cash out there, and yes I want to see him hopefully deploy that. But I want to see him deploy it in a rational and good return-on-investment type business. He's still able to grow his business he's currently got," Meredith said.

Turning it around

The analyst sees Berkshire's collection of financial businesses, like insurance, coming back into favor.

Meredith called out Berkshire's GEICO as an example of one of the company's core businesses that's set for a turnaround after years of investments. Berkshire's insurance businesses accounted for $204 billion of the company's total $248 billion in revenue last year.

GEICO's "now at the point where it's turning the corner, where its profitability is finally kind of at the area where they need it to be," the analyst added. "Therefore you're going to start to see them garner market share and grow again in the marketplace."

It's worth noting that when the preference for value stocks briefly came back into favor at the end of 2018 following the market's steep Christmastime sell-off, Berkshire's performance once again topped the market. Through the end of last year, Berkshire led the S&P 500 on a five-year and 15-year basis.

For her part, Baldwin's Buckley said that her firm's continued investment in Berkshire depends on the company's vision for the future, including board renewal and governance initiatives.

"Important are our concerns about Berkshire's governance structure, particularly its entrenched board, limited financial transparency and cursory efforts at recognizing environmental, social and governance risks to its consolidated operating model," she added.

"Since we argue corporate transparency as key to long-term profitability and shareholder value, we take issue with Berkshire's continually elusive communications with shareholders and have placed our position under review for potential exit," she added.

To review video of Berkshire's past annual meetings and other Buffett interviews go to CNBC's Warren Buffett Archive.

No comments:

Post a Comment