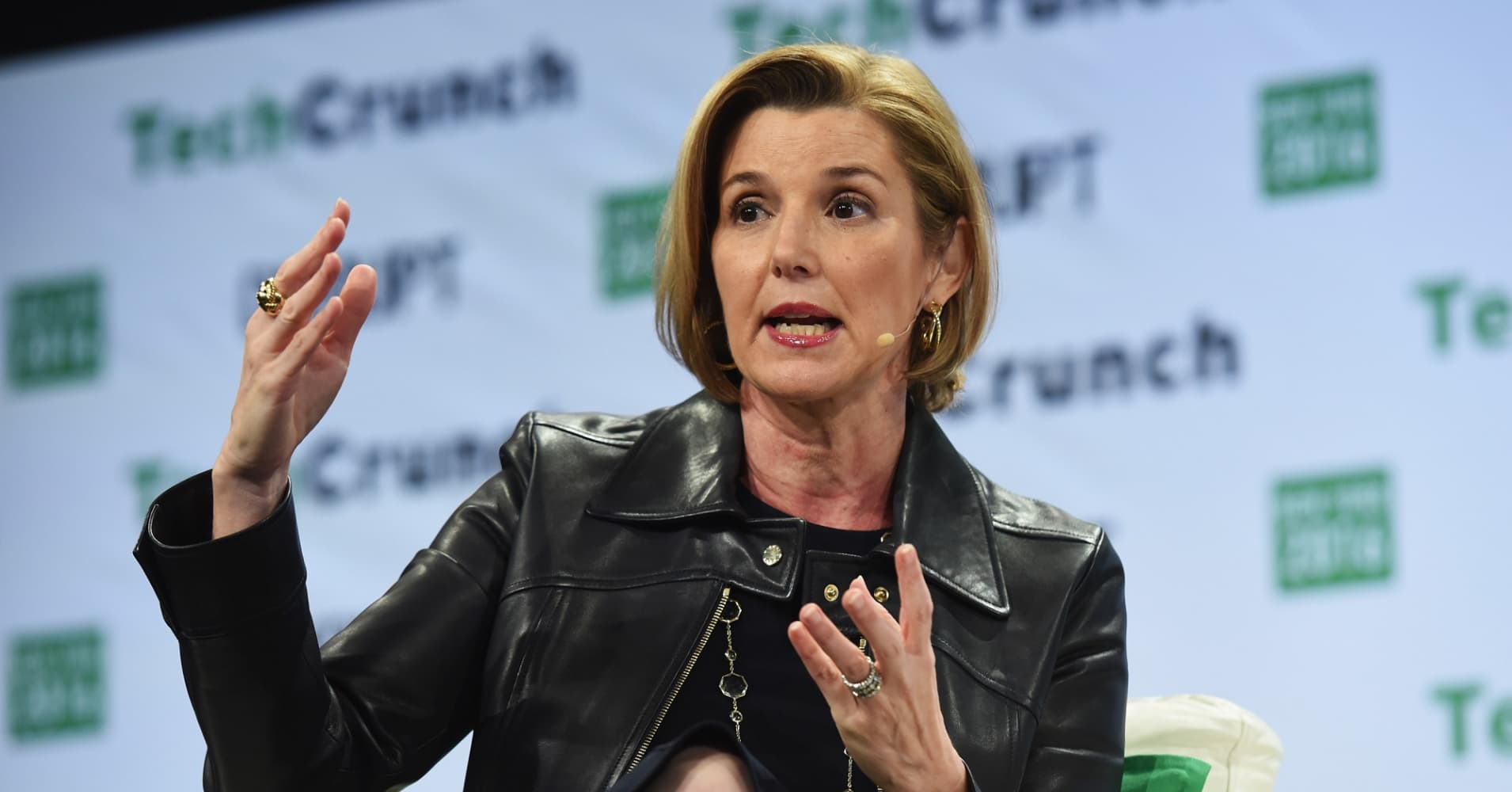

Sallie Krawcheck, co-founder and CEO of Ellevest and former Wall Street executive, has said that the worst financial advice she's ever heard is that you can always start later.

Her counterpoint is simple: Don't wait to invest in your future self.

In fact, Krawcheck told an audience of 150 women entrepreneurs at a conference hosted by Jennifer Bett Communications, anyone can start building their investing prowess right now.

The Ellevest CEO recommends investing 10 percent of your take-home pay, no matter how much you earn. Can't afford to invest 10 percent? Start with 1 percent and aim to gradually increase that amount over time.

The easiest way to do this, according to Krawcheck, is to have a certain percentage of your paycheck auto-deposited into your employer-sponsored 401(k), if you have one. (If you don't, consider other options, like funding a traditional or Roth IRA.) Self-made millionaire Tony Robbins also swears by this "pay yourself first" trick, and recommends the method for those looking to retire rich on an average income.

Krawcheck says she understands that about 50 percent of any individual's income probably goes towards rent and household expenses — more, in some markets (New York rent, she says, is "ridiculous.") And she says it's OK to spend 30 percent of your income on fun — activities like going to dinner with friend or seeing a show — since, she says, "we only live one time, for all I know."

But failing to invest, no matter how small the amount, is like letting $100 fall through a hole in your purse every single day, says Krawcheck. "How long does it take you to fix your bag? No time, and yet we let this money go right past us."

This mindset is formed in childhood, when Krawcheck says women are "taught that money is for boys." Financial advice for young women is usually about saving, as opposed to the investing advice that young men may receive. Krawcheck believes that financial savvy is key to gender equality.

Once you do start investing, don't obsess over the ups and downs of the market. Krawcheck says that when it was fluctuating towards the end of 2018, she just didn't look. Market fluctuations are normal and to be expected, and if your investments are diverse and you leave them to grow over time, your portfolio will recover from ordinary market changes.

Warren Buffett agrees with this buy-and-hold strategy. In response to wild market fluctuations in 2016 he told CNBC that those worried about their savings shouldn't "watch the market closely...If they're trying to buy and sell stocks, and worry when they go down a little bit … and think they should maybe sell them when they go up, they're not going to have very good results."

Like this story? Subscribe to CNBC Make It on YouTube!

Don't miss: 'Shark Tank' billionaire Mark Cuban: 'If I were going to start a business today,' here's what it would be

No comments:

Post a Comment