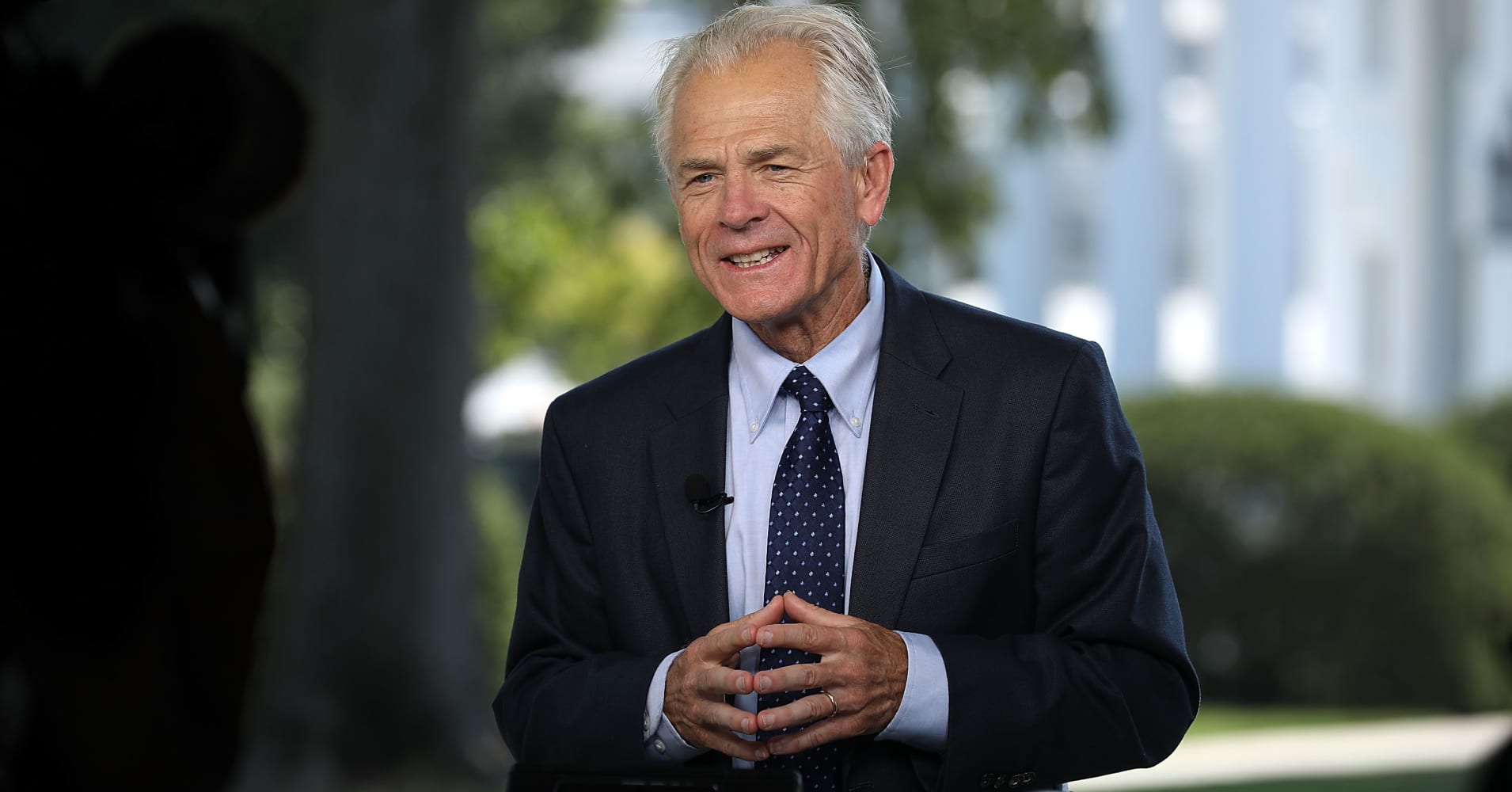

White House advisor Peter Navarro, just hours after President Donald Trump blasted the Federal Reserve, doubled down Monday, singling out the central bank as the biggest threat to U.S. economic growth.

Appearing on "Squawk on the Street," Navarro said the Fed should pause its interest rate hikes — not because growth is slowing, but because growth is strong with barely any inflation.

The president, who has repeatedly slammed Fed Chairman Jerome Powell increasing rates, tweeted Monday that it's "incredible" that the Fed is "even considering yet another interest rate hike."

It is incredible that with a very strong dollar and virtually no inflation, the outside world blowing up around us, Paris is burning and China way down, the Fed is even considering yet another interest rate hike. Take the Victory

Navarro said Trump is in good company, citing a Wall Street Journal op-ed from legendary investor Stanley Druckenmiller and former Fed Gov. Kevin Warsh. They urged central bankers to pause their "double-barreled blitz of higher interest rates and tighter liquidity."

The Fed holds its final, scheduled monetary policy meeting of the year Tuesday and Wednesday. A rate increase, which the market still expects, would be the fourth in 2018. After its September hike, central bankers projected three moves next year. The Fed will deliver an updated rate path Wednesday afternoon. Economists expect the path to be scaled back.

This is a breaking news story. Check back shortly for updates.

from Top News & Analysis https://ift.tt/2PIh37F

No comments:

Post a Comment