Semiconductor producer Skyworks Solutions was downgraded at Citigroup on Monday in light of Apple's weaker-than-expected iPhone XR outlook and softer smartphone demand in China.

"We are downgrading Skyworks Solutions to neutral from buy post the earnings season based on broad smartphone weakness observation in China and disappointing iPhone XR unit sales, which will likely hinder radio frequency semis growth in 2019," analyst Atif Malik wrote in a note to clients. "Additionally, we now think that 5G is a 2020 story versus our prior 2019 view with little upside in 2019 from 5G implementation."

Malik wrote that during Skyworks's September-quarter earnings call, management noted that a unit decline in premium smartphone and overall China softness were driving a below-seasonal December quarter. Company leadership said the March quarter expected be be down 12 percent on a seasonal basis.

Citi cut its price target on Skyworks to $85 represents from $116, representing 10.8 percent upside from Friday's close.

Chip stocks were among last year's most popular trades, as names like Nvidia, Applied Materials and Broadcom posted double- and triple-digit returns. But those names have fared far worse in 2018, as the once-hot chip stocks into correction territory. The iShares PHLX Semiconductor ETF is down more than 16 percent from its 52-week high reached in March,

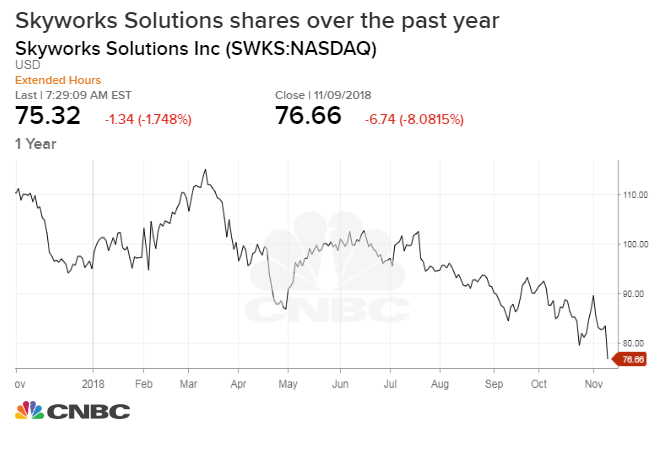

Skyworks, too, has greatly underperformed the broader stock market in 2018, down 19.2 percent versus the S&P 500's 4 percent gain.

While Citi may expect cooler performance from Skyworks over the next 12 months, Malik said that the company expects 5G to create new lanes of spectrum and to be a "meaningful catalyst" in 2020. The total addressable market opportunity would be an additional $7 million to $8 million to the 4G market today of around $15 million.

The analyst also cut his price target on Nvidia shares on Monday, though maintained his buy rating on the Santa Clara, California chipmaker. Malik reduced his price target on the stock to $270 from $300 based on market multiple compression.

"We believe quarter-to-date gaming demand for Nvidia look in-line with expectations supported by Intel's commentary on PC gaming demand strength in September-quarter partially offset by some residual decline in crypto demand in gaming line," the analyst wrote. "

No comments:

Post a Comment