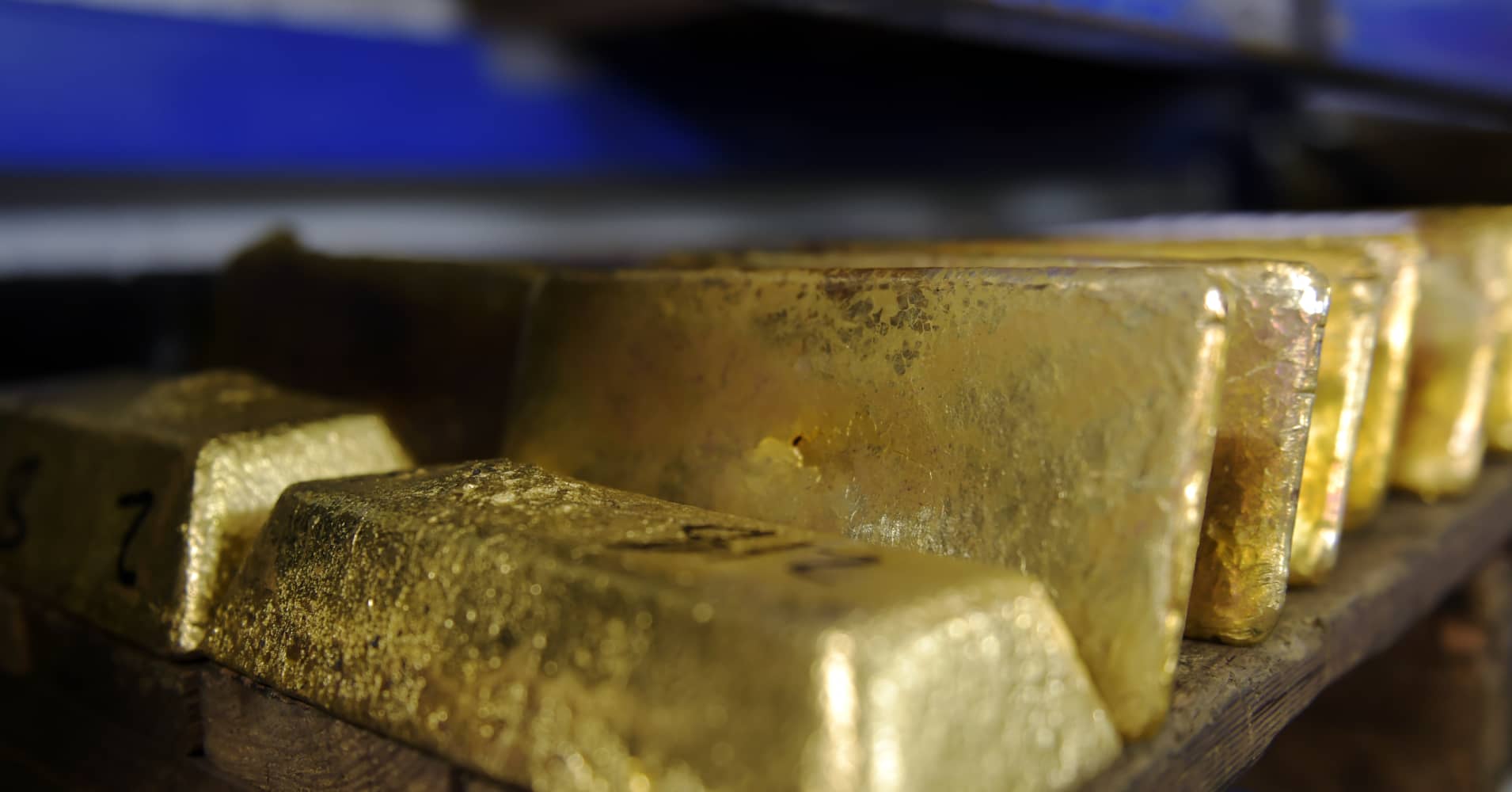

Gold is poised to move higher later this year, powered by the Federal Reserve's less aggressive stance on interest rates and lingering global uncertainties, a precious metals expert said Tuesday.

Central banks have been buying gold at levels not seen in 50 years, as part of a broader diversification of reserves away from currencies including the U.S. dollar.

Concerns over the global economy and geopolitical issues including the trade war between the United States and China have added to uncertainty, which often benefits gold that's considered a safe haven — or assets that tend to retain or increase their value even during market turbulence.

Spot gold was trading at about $1,286.646 an ounce as of 0645 GMT on Tuesday.

Gold prices have largely been stuck in a range of between $1,217 to $1,330, according to Martin Huxley, Singapore-based global head of precious metals at financial services company INTL FCStone. But he said that could change.

"I think that we expect gold to continue to trade pretty much within that range for the coming months," Huxley told CNBC on Tuesday. "But over the second half of the year we expect it then to grind higher, and potentially it could test 1,400 towards the end of the year," he added, referring to gold's price per ounce in relation to the dollar.

Huxley said the Federal Reserve's signal that there will be no more interest rate hikes this year has helped boost the outlook for gold and other metals.

"The view is that there won't be any interest rate rises this year, which again will be supportive for the precious metals sector," Huxley said.

Huxley is not alone in his view on gold. Metals expert Suki Cooper of Standard Chartered said last month she expects bullion prices to move higher this year.

"We expect gold to end the year on a strong note," Cooper said on CNBC's "Futures Now". "It's in the fourth quarter that we'll see gold prices testing the highs that we saw in 2018 and 2017, and potentially matching the highs from five years ago."

INTL FCStone's Huxley, who runs the firm's sales and trading desk, also said that central banks purchased a reported 650 metric tons of gold last year — an amount he said is about 15 percent of the global market.

"And turn the clock back maybe 10 years, before the financial crisis, central banks were net sellers of gold and now there's a dramatic twist, probably a thousand ton twist," he said.

He said that the move into gold is not just by countries such as Russia and Kazakhstan as central banks in Poland, Hungary, the Philippines and, more recently, China have joined in.

"The fact that central banks and the official sector are diversifying their reserves, I think, is a very positive statement for the sector," he said.

Huxley also said that concerns over global trade, political uncertainty in the United States — which faces a presidential election next year — and problems in the European Union, are issues to be considered for investors.

"I think those factors will generally be supportive for gold," he told CNBC later.

— CNBC's Stephanie Landsman contributed to this report.

No comments:

Post a Comment