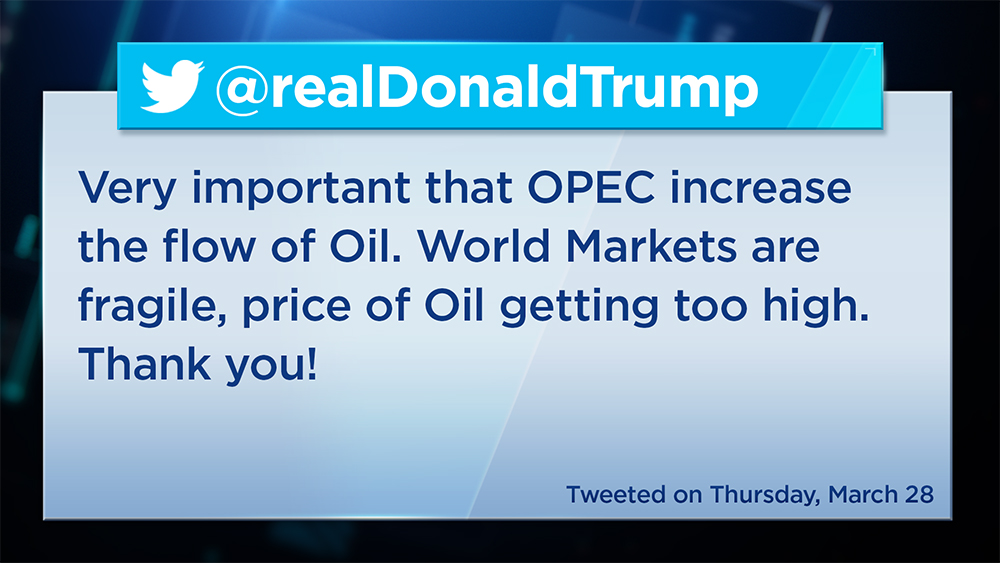

The energy expert who predicted the 2015 crude collapse is taking on President Donald Trump's latest oil tweet.

Tom Kloza, the Oil Price Information Service's global head of energy analysis, believes the real motivation behind Trump's tweet isn't oil — it's rising gasoline prices. RBOB gasoline futures are surging 42 percent so far this year.

"The gasoline market — which is really what he watches and what is so, so crucial to his core states that he needs to hold — it had moved up on retail maybe 60 to 90 cents [a gallon] in some of those red states," Kloza said Thursday on CNBC's "Futures Now." "RBOB futures have been an incredibly overcrowded trade."

That's why Kloza views it as a temporary situation.

"We've had most of the rally in gasoline," Kloza said. "We're probably nearing the peak for this first half of the year for gasoline futures, and we're not going to see many more increases east of the Rockies for prices at the pump."

As of Thursday, the AAA reports the average national price for unleaded gasoline is $2.68 a gallon. The highest prices are in California, Hawaii, Nevada, Washington, Illinois, Michigan and Pennsylvania, where prices are averaging between $2.80 and $3.57 a gallon.

Kloza may see fuel prices falling, but he's building a bullish case for oil.

With refineries coming back online from maintenance and a potential policy to tighten the screws on Iranian exports in the works, he believes higher prices are on the way.

"The reality is the second quarter is shaping up to be a pretty solid quarter where demand for crude outpaces supply," Kloza said. "We're probably going to see higher crude prices a month from now."

He's calling for WTI crude to mostly trade in the $60-a-barrel range in the second quarter while Brent prices rise above $70, at least $10 above current levels.

No comments:

Post a Comment