Companies are hopping over a lowered bar this earnings season, but still getting rewarded mightily for it as investors expected results to be much worse.

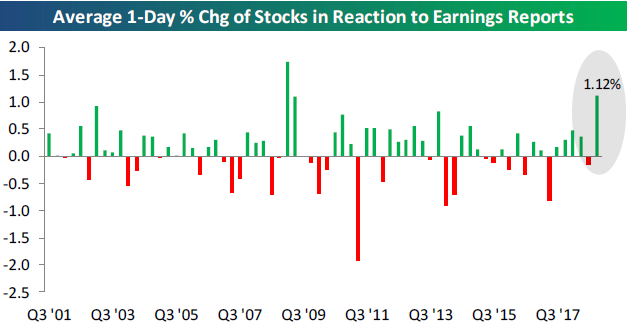

Companies that reported earnings so far this season have seen their stocks rise 1.12 percent on average. If that performance holds for the rest of the season, it will be the best earnings season in terms of stock performance in nine years, according to Bespoke Investment Group.

Source: Bespoke Investment Group

"Part of the reason that the market reacted so positively to the earnings is because expectations had fallen into this earnings season," Tom Essaye, founder of Sevens Report Research, said in an interview. "From a sentiment perspective, it was definitely better than what people were afraid of. People were afraid the earnings season was going to show businesses are falling off a cliff."

"It did not show that, and in the logic of markets, that means we buy stocks," he added.

This earnings season turned out to be better-than-feared as investors had braced for more disappointing results with the tax-cut boost fading and a global economic slowdown. Companies are stepping over a very low bar as the consensus estimate for fourth quarter S&P 500 growth has fallen significantly to 11.9 percent from 17.8 percent five months ago. The stock market is out of its December slump as the S&P 500 has posted a nearly 8 percent gain in the new year.

The better-than-feared trend is best showcased in tech giant Apple, which saw its shares soaring last week when it reported earnings barely beating estimates andlowered revenue projections on a sales slowdown in China.

However, investors might have been just ignoring the bad news as the growth estimates in 2019 are pointing to a big deceleration.

Wall Street analysts are slashing their estimates for the next quarter at a record pace. According to FactSet, the first quarter bottom-up earnings per share estimate has dropped by 4.1 percent during January, which is a larger decline than the 5-year, 10-year, and 15-year averages.

"If I'm a bull, one of my big concerns is that where the earnings growth is going to come from and what's going to stop this decline. What's going to be a positive catalyst? I don't think we have one at this moment," Essaye said.

EBIT margin consensus estimates for 2019 have fallen by 60 basis points since October of 2018, the most significant downward revision since the financial crisis, according to Morgan Stanley. The bank also pointed out the ratio of negative to positive guidance for the first quarter is the highest since 2016, when we last had an earnings recession.

"Earnings growth is rolling over even faster than we thought it would with revisions breadth falling in just about every sector. Quite frankly, we are surprised at the lack of acknowledgement of this deterioration by most analysts and commentators...We think objectivity on quarterly earnings reports is being swayed by the price reaction in the stocks," Mike Wilson, Morgan Stanley's chief U.S. equity strategist said in a note on Monday.

No comments:

Post a Comment