The GOP tax bill, which was passed in December 2017, made some sweeping changes, including adjusting the income tax brackets. But many Americans are still confused about the new law and how it will affect them.

"More than one-quarter of Americans (28 percent) are unsure of what exactly changed with the passage of the Tax Cuts and Jobs Act of 2017," NerdWallet reports in its 2019 Tax Study, "and about half (48 percent) don't understand how it affects their tax bracket."

NerdWallet's 2018 Tax Study found that an increasing share of Americans don't know their income tax bracket at all: 48 percent, compared to 40 percent in 2016.

While the new law maintains the seven-bracket system, Congress tweaked the rates and income levels at which they apply. The seven tax brackets used to be 10 percent, 15 percent, 25 percent, 28 percent, 33 percent, 35 percent and 39.6 percent. Those are the brackets that applied to the tax return you filed in 2018.

The new rates, which relate to the tax return you'll file in 2019, are 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37 percent.

NerdWallet broke down the 2018 and 2019 federal income tax brackets. Below are the 2018 brackets, which relate to the tax return you're filing in 2019.

2018 tax brackets and rates for single filers

Click to enlarge

2018 tax brackets and rates for married couples filing jointly

Click to enlarge

2018 tax brackets and rates for married couples filing separately

Click to enlarge

2018 tax brackets and rates for head of household filers

Click to enlarge

If you're confused as to how tax brackets work, you're not alone: One in 14 Americans don't even know what a tax bracket is, NerdWallet found in its 2018 Tax Study.

The U.S. uses a progressive tax system which, in short, means that higher income tax rates generally apply to people with higher incomes.

"Being 'in' a tax bracket doesn't mean you pay that federal income tax rate on everything you make," NerdWallet notes, giving the example of a single filer with $32,000 in taxable income. That person would be in the 12 percent tax bracket but wouldn't actually pay 12 percent of the full $32,000. Instead, they pay would 10 percent on the first $9,525 and 12 percent on the rest.

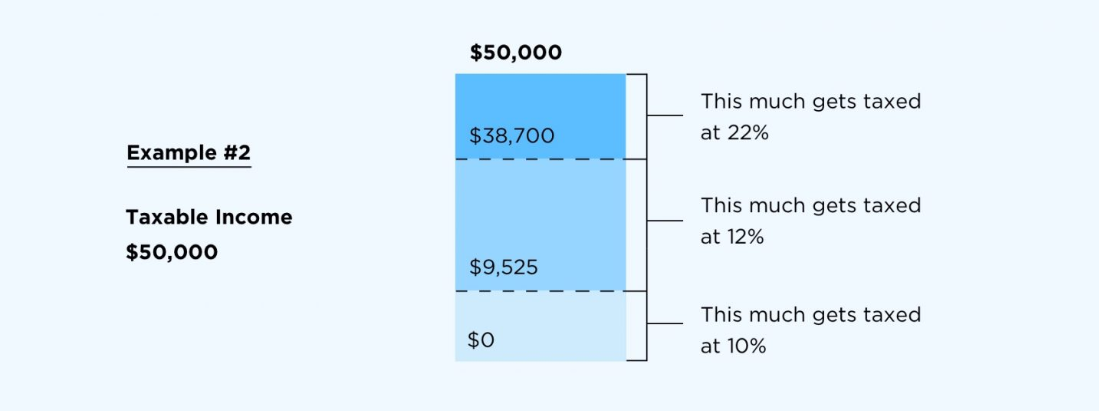

An individual earning $50,000 would pay 10 percent on the first $9,525, 12 percent on the chunk of income between $9,526 and $38,700 and 22 percent on the rest.

"The total bill would be about $6,900," NerdWallet explains, or "about 14 percent of your taxable income, even though you're in the 22 percent bracket."

Note that these are the rules for federal income taxes, NerdWallet adds: "Your state might have different brackets, a flat income tax or no income tax at all."

Don't miss: 80 percent of people missed a step related to taxes in 2018, and it could affect their refund

Like this story? Subscribe to CNBC Make It on YouTube!

No comments:

Post a Comment