Biotech stocks are booming as deal chatter in the space heats up.

The Nasdaq Biotech ETF IBB and the SPDR S&P Biotech ETF XBI rallied 3.3 and 6 percent, respectively, on Monday after Eli Lilly said it would buy Loxo Oncology $8 billion in its largest acquisition ever.

While these seem like similar investments, they are actually quite different.

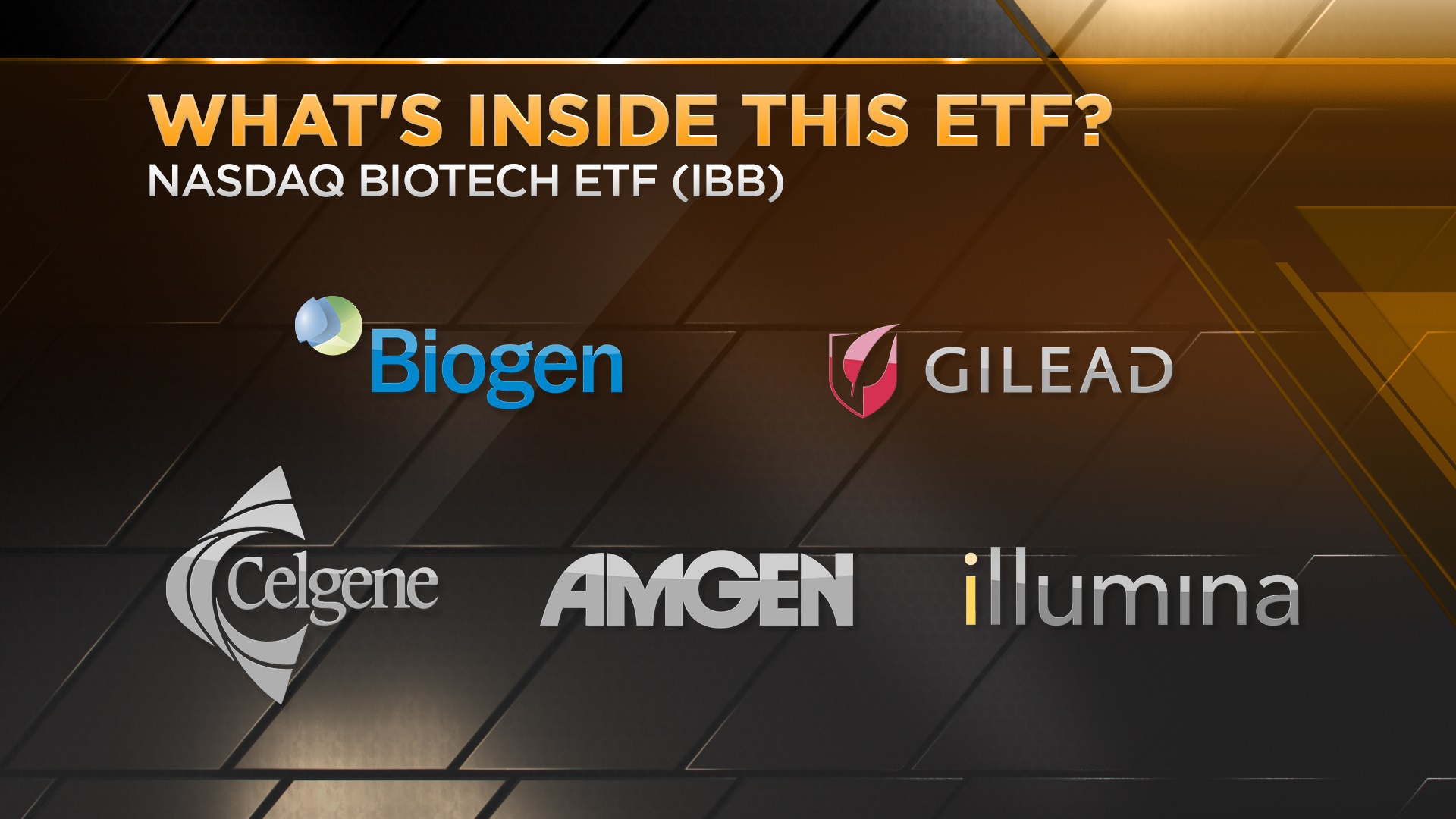

Yes, the IBB and the XBI have "biotech" in the name, but it's what's inside that counts.

The IBB is a market cap weighted index. So big names like Celgene and Gilead have prominent weightings. The top 10 holdings are 56 percent of the weighting, and there are 225 companies in the index.

The XBI is a modified equal weight index, so most of the 120 companies in the fund have small weightings (1 to 2 percent typically.) The top 10 holdings are only 15 percent of the fund.

So, which should you buy in biotech?

In times when the overall market is rising fast, as in the middle of 2018, an equal-weighted index will often outperform, which is what happened in mid-2018: The XBI outperformed the IBB.

But when the market heads south fast, it is often small stocks in high growth industries that are sold more aggressively, and that's what happened in the fourth quarter of 2018: The XBI underperformed the IBB.

How should you play it in the case of the recent rally?

"It's really a question of whether you are looking for long-based broad exposure or if you are trying to catch a particular earnings season," Dave Nadig, managing director of ETF.com, said Monday on CNBC's "ETF Edge." "I think the equal-weighted strategy here — the XBI — gives you that broad exposure and it's actually a little bit cheaper so you're kind of getting a double whammy here."

The IBB and XBI are up 19 and 23 percent, respectively, since the market's December low.

from Top News & Analysis https://cnb.cx/2LXYtbn

No comments:

Post a Comment