Investors looking to cheer up should take a close look at just how miserable most investors are.

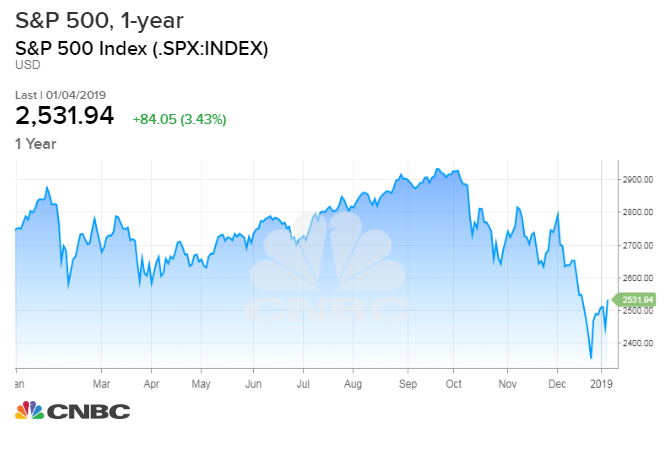

The three-month collapse in stocks, punctuated by searing day-to-day volatility, may or may not have properly priced in an appropriately dimmer outlook for economic growth and policy risks.

But the bear raid has undeniably shredded the nerves of investors, sapped risk appetites, built a tall wall of worry, replaced greed with fear — to the point where overall Wall Street sentiment has reached a zone where it represents a bullish factor for forward returns. If nothing else, it means incremental bad news — trade standoff, more corporate profit warnings — won't come as much of a shock.

In most cases, the level of pessimism as gauged by surveys, fund flows and professional investor positioning has reached readings comparable with prior serious market setbacks outside of a recession: 2015 to early 2016; late 2011; and 1998.

A collective bad mood helps create a good set-up for powerful recoveries after those market gut checks, typically because negative sentiment has usually accompanied concentrated bouts of selling that don't last long without at least an interim reversal.

Global strategist Michael Hartnett of Bank of America Merrill Lynch – correctly bearish for many months – said Friday morning was "time to buy" for a tactical bounce based entirely on heavy fund outflows, overwhelming pessimism and brutal losses already booked in global stocks. Not the ultimate low, he says — for that we need profit forecasts to trough and the Federal Reserve to step away entirely and maybe go to an easing bias.

Disclaimer: Extreme bearish attitudes can get more extreme, and we now seem in a market where the overshoots occur to the downside and not up. If we are truly on the cusp of a recession or some credit-market "accident," then the skeptical attitudes will be less a contrarian signal than an appropriate reflection of further downside risk.

So an abundance of investors looking on the dim side of things doesn't in itself mean the Dec. 24 low in the S&P 500 below 2350 will prove a durable bottom, or that the 8 percent rally from those depths through Friday's 3-percent pop is the start of a run anywhere near the old highs above 2900.

But fear is fuel for rallies, and the tank was so full after December that plenty more could be burned off in the form of further gains — even if the news doesn't get noticeably better.

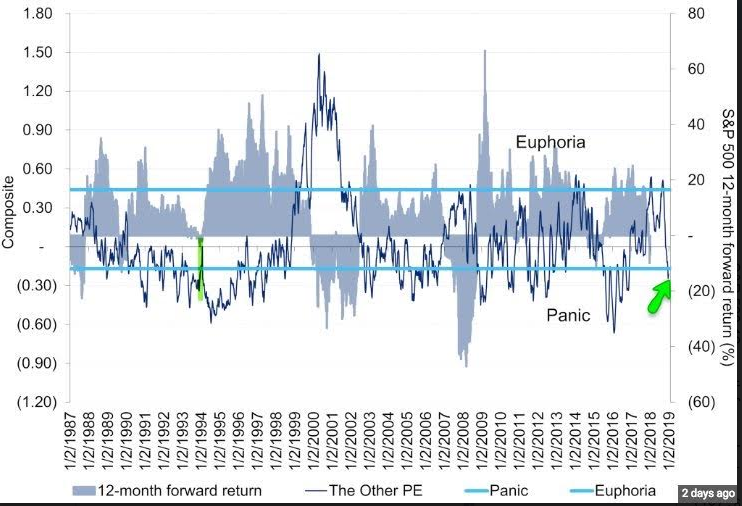

The Citi Panic-Euphoria Index — a composite of technical, survey and fund-flow trends — cracked into Panic territory last week. When in this zone, it doesn't mean a market low has been set, but 12 months ahead S&P 500 returns have almost always been positive.:

The long-running Consensus Inc, weekly gauge of professional sentiment has rushed to the bearish side of the boat, at levels last seen in 2011 — though not yet matching the farthest extremes from the 2011 sovereign-debt panic:

Deutsche Bank calculates that long-short equity hedge funds have their lowest overall market exposure since 2011, having been chased out of positions in December.

Individuals in December purged a record $86 billion from global equity mutual funds and ETFs — further evidence of loss of faith in the market.

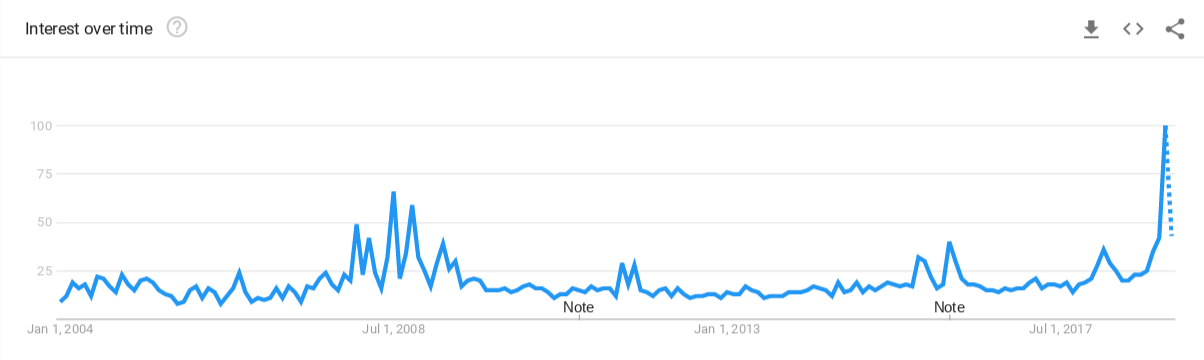

Web surfers have been busily searching for information on bear markets — whether the definition of one or how they behave or how to hide from one.

Google search frequency for "bear market.":

On a more impressionistic level, last Thursday saw a saturating volume and intensity of bad news and negative extrapolation of scary trends. Apple's clanging sales warning confirmed investors worst fears about the once-largest stock in the world. The jarring drop in the ISM manufacturing index followed ugly industrial data in China, whipping up recession predictions and spurring a near buying panic in Treasuries, as the 10-year yield sank below 2.6 percent and the yield curve flattened hard.

This clenching-up of risk markets set the scene for Friday's huge rally after a strong jobs number muted some U.S. growth fears and Fed Chairman Jerome Powell conveyed patience and flexibility about the path of monetary policy this year.

Friday was the second time in two weeks when 95 percent of NYSE volume was in advancing stocks. That's only occurred three other times, in 1982, early 1987 and summer of 2011, according to SentimenTrader.com. In each instance, the S&P was up strongly (between 12 and 30 percent) six months later. Small sample, no guarantees, but interesting.

Working against all this is the fact that the fiercest rallies tend to happen in downtrends with the tape under extreme stress. The VIX futures market remains agitated in a way that says the market is still untrustworthy. Credit markets caught a bid Friday but are wobbly.

The way to tie it all together: Stocks remain washed-out and hated enough to allow for some further gains. Which means if the market can't follow through soon with another upside effort, it will not speak well of the bulls' near-term chances.

And if the rally does carry on for a bit, stiff tests lie ahead — indeed just 3 percent up from Friday's close, the S&P would run into lots of friction near the lower end of its previous, failed range.

No comments:

Post a Comment