Stocks have bounced hard off the Christmas Eve lows and many of the worst performers are the stars of the two-week period since then, including General Electric, Netflix and many energy names.

"It was a dash for trash as the new year has come into play," said Todd Sohn, technical analyst at Strategas Research.

Investors are watching the action to see if new market leadership will emerge and whether the market is showing signs of having found a bottom. However, they say it will take time to tell, and there's still a lot of doubt as to whether the move higher is a sign of recovery, or simply a bear market rally.

"I think that could be the low, but I still think it will be a process," said Frank Cappelleri, Instinet executive director. ""We have some ability of the market to show it can create a higher low. There's a cushion now in place in front of earnings season."

Sohn said he doubts the bottom is set. "Is this just a a bounce in a bear market or the start of some more durable advance. i think it's too premature to say which one it is," he said.

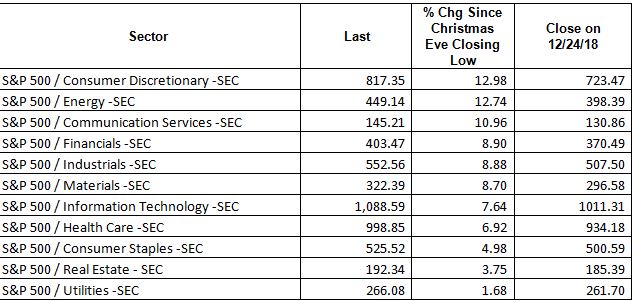

The S&P 500 is up 8.5 percent since the close on Dec. 24, but the small cap Russell 2000 has sprung back more, up 11 percent. General Electric, down 33 percent in the fourth quarter has rebounded 26 percent in the last two weeks. Netflix, off 28 percent in the fourth quarter has risen 35 percent in two weeks.

The bounce back in the most beaten down names is also a typical New Year's phenomena, when investors look for bargains among the rubble of the last year. But this year, there are a lot of stocks to choose from.

"Anytime you have a big market sell off, the most oversold area is going to bounce back the fastest. The same with microcaps and small caps. That's typical of what we see. We have to see how leadership develops here," said Cappelleri. "It got crushed on the way down." Cappelleri said in the rout of 2017, tech bounced back strongly, but that may not happen this time and that group may not be the leaders next time around.

Energy has been a laggard and a number of companies, like Marathon Oil, Hess, Noble Energy and Newfield Exploration are all at the top of the turnaround list and up more than 20 percent.

"I think for energy, they were so beaten down and oversold that you could buy them here for a bounce play. I would have to question their longer term leadership," said Sohn. "Over the past few months, [leaders have] been the staples and utilities."

The staples and utilities have performed the worst since Dec. 24, with just single digit gains. Communications services, which includes internet names, is up about 11 percent.

Strategists say if the market continues to move, the next area that will be a big test for the S&P 500 is 2,600, the bottom of a range it traded in for weeks. The S&P 500 was up 0.7 percent Monday to 2,549.

"We'll probably see some sort of pullback soon. We're up 9 percent in 8 days. I look at Oct. 29 to Nov. 7, when the market rallied 8 percent...that was the beginning of the range 2,600 to 2,800. We had four to five weeks before the bottom fell out. It was a large 200 point level for the S&P and I think what everyone is watching now is how the S&P is going to do when it gets back to the 2,600 zone," said Cappelleri. "Everything got so depressed this time versus last time . It has a better chance of snapping back in a more meaningful way."

No comments:

Post a Comment