New year, new market: Turning the calendar over can make a world of difference.

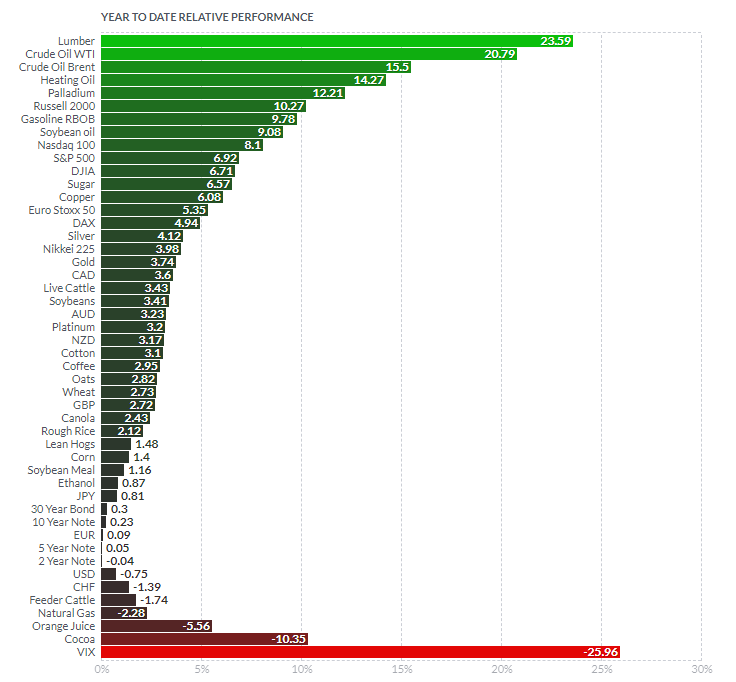

The majority of financial assets ranging from lumber and crude futures to the Japanese yen all rose in January. Lumber and crude are both up more than 20 percent in 2019 while the yen has registered a small gain. The S&P 500, the benchmark index for U.S. stocks, is among the best performers, rising about 7 percent this month. Exchange-traded products that track emerging market stocks and bonds are also up for the year. Through Thursday's session, only seven major assets: were negative this month, including cocoa and orange juice futures as well as the U.S. dollar.

Source: Finviz.com

This broad-based rally comes in stark contrast to last year, when only 10 asset classes registered gains. Cocoa futures, wheat, natural gas, palladium and the U.S. dollar were among those assets. Meanwhile, the S&P 500 dropped 6.2 percent in 2018 while crude and lumber both fell more than 20 percent.

Source: Finviz.com

"January was the snap back from a deeply oversold December," said Nicholas Colas, co-founder of DataTrek Research, in a note to clients. "The worse an asset class performed last month/last year, the better it did this month. By and large 'the last shall be first' was January's tagline."

However, a rip-roaring rally this early in the year is not giving Colas much solace that 2019 will be a better year than 2018.

In his note Thursday, Colas points to when he was a trader at SAC Capital Advisors, a hedge fund that was run by Steven Cohen. Back then, every trader could see how the other traders at the hedge fund were performing in real time.

"Once in a while, the entire organization would sync up, with every trader showing a healthy gain for the day," Colas said. "This usually happened shortly after the open, at which point someone would invariably yell, 'Close the market!'"

"As I look at the YTD performance for global capital markets, I can't help but think many investors wish they could close out the year right now rather than face the next 11 months. It doesn't work that way, of course," Colas adds.

Investors will have to face a number of hurdles over the next 11 months, including slowing economic growth, declining year-over-year earnings growth and lingering uncertainty around U.S.-China trade relations.

The good news for investors is the S&P 500 usually ends the year higher when January is a positive month. Since 1950, the S&P 500 has posted an annual gain 87 percent of the time when January is a positive month, according to The Stock Trader's Almanac.

from Top News & Analysis https://cnb.cx/2DMCzWg

No comments:

Post a Comment