Best Buy shares dropped on Monday after Bank of America Merrill Lynch downgraded the stock to underperform (the firm's equivalent of a sell rating), citing slowing sales of electronics, including the iPhone.

The firm cited "deceleration in industry growth trends and continued caution on key product categories such as TVs, Apple products and gaming," stated the Monday note by analyst Curtis Nagle. "We are turning more negative as we now see a higher possibility that BBY may see an outright comp miss in 4Q and we believe Street 2019/20 EPS [estimates] are too high."

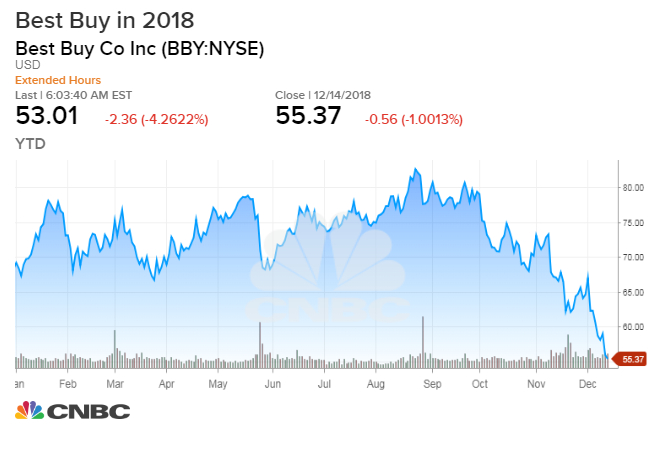

Nagle also cut his price target by $20 to $50. The stock fell 4 percent in premarket trading to $53.01 on Monday, set to add to a 30 percent decline this quarter amid the key holiday shopping season. Nagle downgraded the stock to neutral in November.

"We lower our FY18-20 EPS estimates which are now 1/6/8% below the Street," the analyst noted.

TVs make up 25 percent of Best Buy's total sales, estimates Bank of America. And Apple products represent 10 percent of sales, the firm said.

"We see headwinds related to the iPhone and a new Apple and Amazon partnership, the note said.

from Top News & Analysis https://ift.tt/2A4GP0T

No comments:

Post a Comment