Stocks plummeted toward bear country, led by the Nasdaq Composite Index, and Wall Street's preferred fear gauge rocketed higher on Thursday.

And strategists say selling will get worse before it gets better.

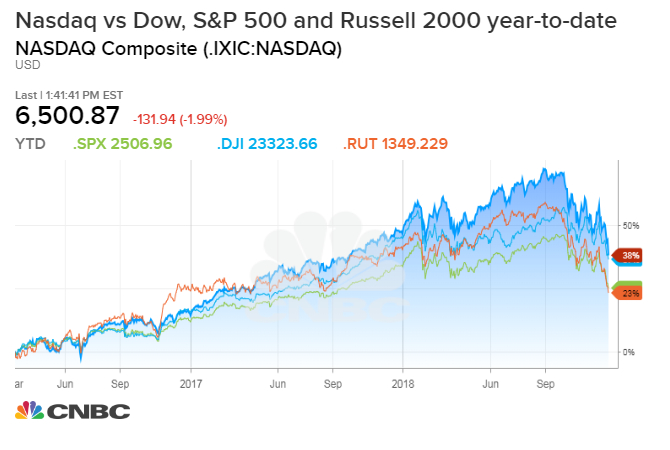

After the Federal Reserve spooked markets Wednesday, risk assets and stocks have been reeling, with some of the sharpest losses on Thursday in growth sectors like biotech and technology. That weighed hard on the Nasdaq, which dropped 2 percent and is now officially in a bear market, down more than 20 percent from its highs. The Dow fell more than 600 points Thursday, through the psychological 23,000 level, and the S&P 500 was off 1.8 percent, or 16 percent from its highs.

The CBOE Volatility Index jumped above 30, its highest since the major market sell-off in February of this year.

"The market's in no man's land," said Peter Boockvar, chief investment strategist at Bleakley Advisory Group. Stocks have broken through the lows of the year, and technicians are scurrying to find the next support levels. On the S&P 500, he said 2,400 is a potential psychological area of support.

The market plunged Thursday against the backdrop of a Congressional feud with the White House over a continuing budget resolution, but the markets were more focused on the worries that have been festering over global growth and the potential for recession.

"You can guarantee if the government shuts down it's going to very soon reopen," said Boockvar. "This could be a carry through from yesterday, that's legitimate. The problem now is this is the first time in years in this bull market that people are doing tax loss selling. That's helping to exaggerate the move. You're also having redemptions." Since the Fed announced its rate hike Wednesday, the Dow is down more than 900 points.

The sharp drop in stocks since early October has been unexpected and even more crushing recently, since December is typically a positive time for stocks. The 10 percent decline so far in the S&P 500 is its worst December performance since 1931. If it remains this way, it would the first time ever that December is the worst month of the year for the index.

"It is entirely possible that looking out over the next three to six moths this correction turns into what you would call a bear market because of the fact that the Fed really didn't show sufficient sensitivity to the affect of policy tightening on the speed of asset price changes to the downside," said Julian Emanuel, chief equity and derivatives strategist at BTIG.

Emanuel said he's not yet worried about a recession, but the fears the Fed will make a policy mistake that could bring one on.

But the Fed is not the only worry. Also topping the list is the uncertainty surrounding the trade negotiations between the U.S. and China. China's economy is already weakening, and Investors worry weaker global growth will spread to the U.S., where the housing sector has begun to show weakness as the Fed raised interest rates.

"From our point of view time wise, we think this correction has further to run, consistent with the past over 10 percent corrections since March 2000," Emanuel said. "Does it have further to run? That will be much more dependent on whether the data starts turning down in a much more meaningful way, and if there's no signs of tangible...progress in negotiations with China."

He added that the broader problems with China could continue but there's still potential for a trade deal before the March deadline, which could appease markets.

Another big concern is a major slowdown in earnings growth. Market consensus is for 7.5 percent growth in 2019 in S&P 500 earnings, down from more than 20 percent this year.

Ed Keon, QMA chief investment strategist and portfolio manager, says his forecast is even more negative—at zero growth.

"How I interpret the market action yesterday and today, I think it basically means the market's convinced it's already too late for the Fed. We already have rates that are high enough to push us into at least a growth recession," he said.

Keon is also concerned about trade. He said when the market turned higher Dec. 3 after President Donald Trump's meeting with Chinese President Xi Jingping, he began lightening up on stocks, and continued to sell into rallies. Stocks ultimately sold off on trade concerns even though the two sides have agreed to hold off on any new tariffs for 90 days and China has made some purchases of U.S. soy beans.

"We remain cautious. We think the market could get worse before it gets better. I still expect a positive year next year, but maybe something like 5 percent. You can get 2 percent in cash, without the volatility…So far we've been selling into rallies and whether we continue to do that, we'll have to see what the options look like," said Keon.

Keon said he was a net seller Thursday, as well and he expects big investors to slow down their activities next week in what's usually an illiquid time between Christmas and New Year's

"We're much more cautious. I've usually been bullish most of my career," he said. He said the market will bottom once everyone becomes sufficiently negative. "We may not be that far away. I don't think it's going to get that much worse."

Michael Arone, chief investment strategist at State Street Global Advisors, also sees more selling ahead and he recommends moving to the safer parts of the stock market, like the S&P aristocrats that have consistently increased their dividends.

"We need to see a bit more of a washout. We're getting closer to those level but I think the holidays will interrupt, and we'll have to see what happens when we regroup in January," he said. "Admittedly, I think the end of the bull market may be on the horizon, but I still think fundamentals will support reasonably high stock prices in 2019.But we shall see."

Arone expects earnings growth to slow as well, but to single digits.

"I definitely think the market is trading on sentiment. Underlying fundamentals are still reasonably okay, and I think that the negative sentiment is feeding on itself to a large degree, so selling begets more selling," he said. "We're seeing a reluctance to come in and buy on the dips. That has supported this bull market for the last 10 years. That's something we're observing from investors.. But I still think this is a kind of normal correction."

Arone said one of his concerns is trade is just one source of friction between the U.S. and China, and a solution could take much longer to find.

"If this is a broader battle between two superpowers for global influence, it's a whole can of worms," he said. "I think what's happening is the market's not sure of what that looks like going forward and therefore, they're reflecting that in lower asset prices until they know whether this is trade or something bigger."

Arone said the Fed has also made itself a bigger problem for stocks, and he says investors should steer clear of growth and momentum names and look for higher quality value.

Federal Reserve Chairman Jerome Powell confused markets Wednesday with the Fed's forecast for lower grwoth but commitment to continue tightening, said Arone. That comes after Powell's previous pivot from a comment that the Fed was far from neutral to a statement that it was near neutral, just a month later. Neutral is the rate where the Fed is no longer seen as being accommodative and where it could stop raising interest rates.

"He was very steadfast on the fact that interest rates will continue to rise, and we're on autopilot on the balance sheet. Yet they're concerned about global risks," he said. "It's like speaking out of both sides of your mouth. Investors are looking for clarity, not confusion...It seems the more he talks, the more confusing it is. Maybe less is more."

Emanuel said the market has worried that Fed tightening, both through rate hikes and its balance sheet roll off, are becoming a problem for risk assets and growth.

Powell said Wednesday, after the Fed hiked rates by a quarter point, that the Fed's balance sheet program was on auto pilot, meaning it would continue to allow $50 billion of Treasury and mortgage securities to roll off each month, as they reach maturity. The Fed has tapered the amount of securiteis it replaces, thereby shrinking its balance sheet.

"The market has not cared at all about the balance sheet reduction and about a week or two ago, it started caring about the balance sheet reduction because the belief was policy was becoming overly tight," Emanuel said.

No comments:

Post a Comment