A Republican who will soon step down as chairman of the U.S. House of Representatives tax committee late on Monday released a sweeping, nearly 300-page tax bill that he said would affect Americans' retirement savings, numerous business tax breaks and redesign the Internal Revenue Service.

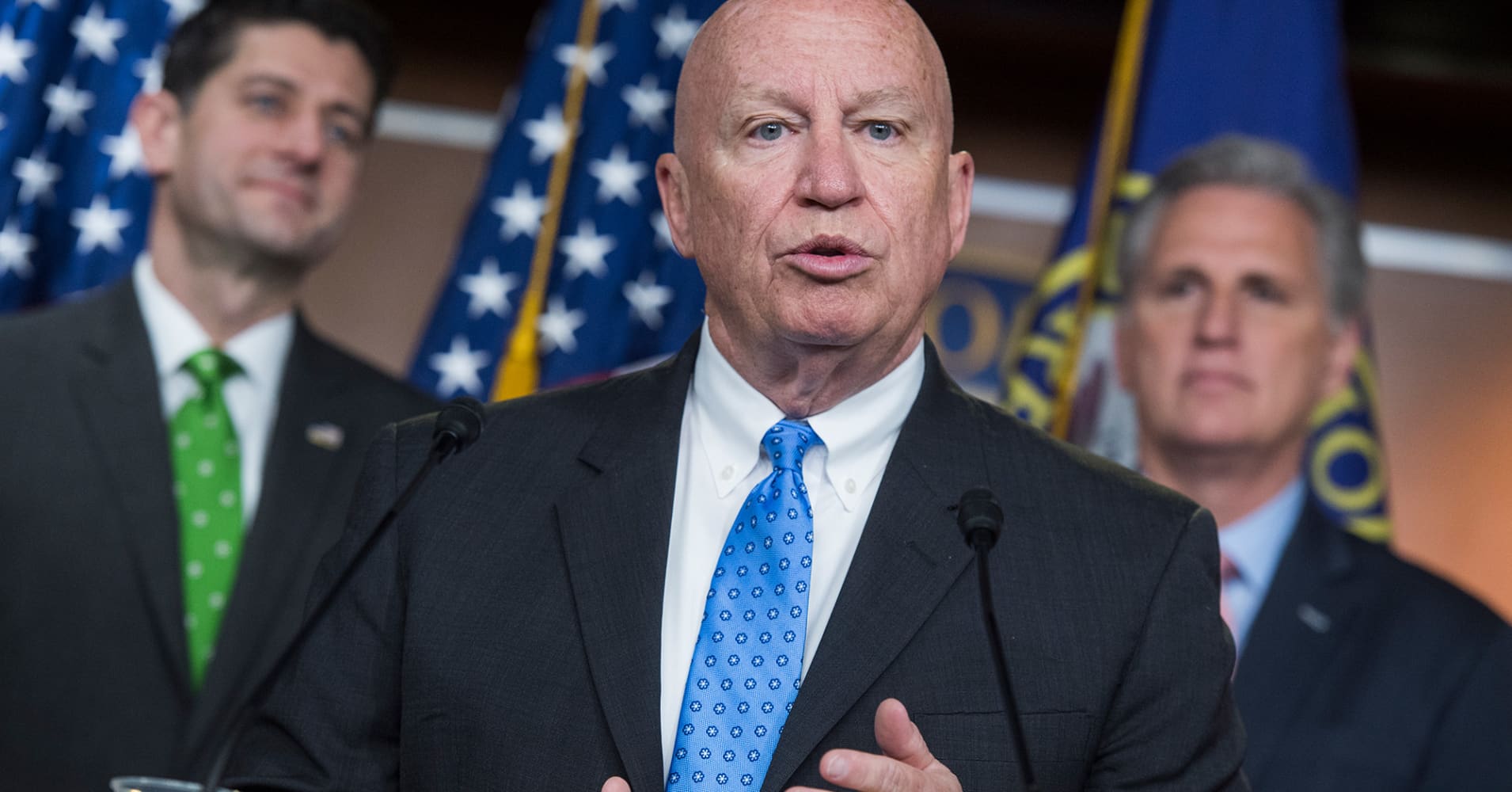

Representative Kevin Brady, chairman of the House Ways and Means Committee only until early January, shepherded through the House and onto President Donald Trump's desk in 2017 a large tax bill that slashed the U.S. corporate tax rate.

Of his latest legislation, Brady said in a statement, "The policy proposals in this package have support of Republicans and Democrats in both chambers. I look forward to swift action in the House to send these measures to the Senate."

American voters ended Republican control of the House in the Nov. 6 elections and handed majority power to the Democrats. Brady is expected to be replaced as committee chairman in January by Democratic Representative Richard Neal.

In the interim, Congress is holding a "lame duck" session in which Republicans such as Brady will still be in charge of the House agenda. No summary of Brady's bill was immediately available, said a spokesman for the lawmaker.

The legislation's outlook was not immediately clear, with Congress likely to be busy in the "lame duck" session with a must-pass spending measure and Trump's renewed demands for money to build a proposed wall along the U.S.-Mexico border.

The 297-page text of the bill covers tax breaks for fuel cell cars, energy efficient homes, race horses, mine safety equipment, auto race tracks and many other items, as well as retirement savings plans such as 401(k)s and individual retirement accounts (IRAs).

The bill also "includes some time-sensitive technical corrections" to the 2017 bill that Trump signed into law, Brady said in the statement.

from Top News & Analysis https://ift.tt/2RgceEb

No comments:

Post a Comment