Apple has been a battleground stock, where bulls hope to make a stand.

But bears want to use Apple as a warning for more weakness. So far, the bears are winning.

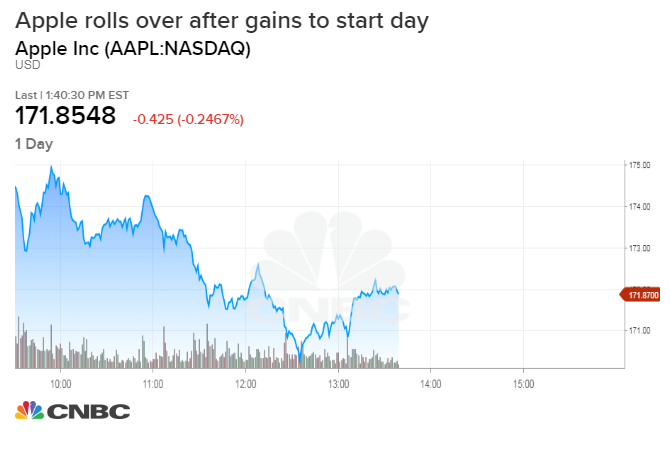

Apple started Monday higher but turned negative and took some steam out of the market rally. Last week, traders pointed to broader market declines that came after a retreat in Apple.

The Dow had been up well by 387 points Monday but was up about 200 points in afternoon trading. At its high, Apple, a Dow stock, added 18 points to the Dow but it's impact is more on sentiment.

"I'm concerned about Apple's drag," said Art Cashin, head of floor operations at UBS. "I think the trouble with Apple is it's one failed product away from disaster."

As of 1:45 ET, Apple shares were clinging to gains.

Apple has been surrounded by doubt about its iPhone sales, and the stock has lost about 24 percent since the start of the quarter. The S&P 500 has lost 8.7 percent in the last period.

"[Apple] pulled down the market somewhat. We faded off highs because of it," said Scott Redler, partner with T3Live.com. Apple touched a high of $174.95 earlier Monday, but then turned negative and was at $171.96 in afternoon trading. It had been as low as $170.26 per share.

Redler said he was watching to see if Apple could get back to $175.50 per share, last Tuesday's low. "It didn't even have the strength to get there, but it took out Friday's low of $172.10 and that was what brought on the selling," he said.

If Apple breaks $170, it could head toward $165 and be a negative weight on tech.

"Every time the market's tried to rally , Apple's not been the leader. It's been a headwind," he said.

from Top News & Analysis https://ift.tt/2Bzb4hM

No comments:

Post a Comment