The Treasury Department refrained from calling China a 'currency manipulator,' a title that's been threatened by multiple U.S. administrations but not used since 1994.

In a report released Wednesday, Treasury said it has found no major trading partner met the criteria to be designated as intentionally manipulating its currency. But it kept China on a watch list along with Germany, Japan, Switzerland, Korea and India.

"The Treasury Department is working vigorously to ensure that our trading partners dismantle unfair barriers that stand in the way of free, fair, and reciprocal trade. Of particular concern are China's lack of currency transparency and the recent weakness in its currency. These pose major challenges to achieving fairer and more balanced trade, and we will continue to monitor and review China's currency practices, including through discussions with the People's Bank of China," said U.S. Treasury Secretary Steven T. Mnuchin.

The decision comes amid an escalating trade conflict with China that could ultimately result in U.S. tariffs on all Chinese exports before it is resolved.

President Donald Trump has also criticized China for weakening the yuan, which helps Chinese exporters and diminishes the impact of tariffs.

Last week, a U.S. official said the U.S. is concerned about the recent depreciation in China's currency, and planned to detail its concerns in a report.

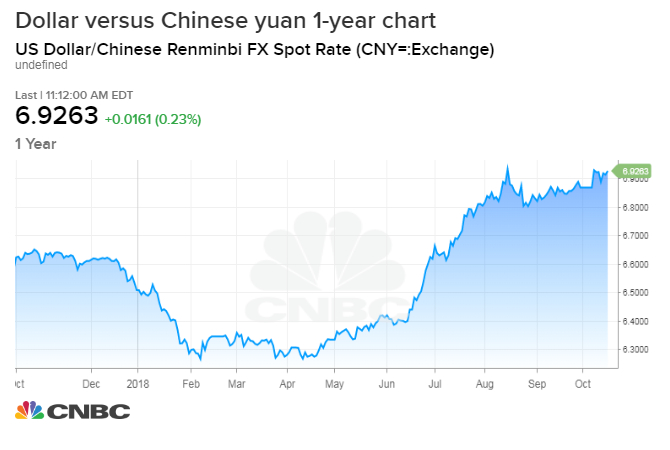

The yuan has edged near 6.93 to the U.S. dollar, a level where it also was trading in August. The yuan, also known as the renminbi, has moved markedly lower since June, when trade tensions started to flare.

Strategists say while China has been criticized for letting the currency fall, it actually has worked to hold the currency back from falling further since it got close to the key 7 level. China's central bank sets a daily exchange rate for the yuan based on recent prices and allows trading against the dollar in a band that could be as much as 2 percent above or below that level.

"It allows U.S. companies to sue China for grievances. It's more of a nuisance than a substantive issue," said Mar Chandler, chief market strategist at Bannockburn Global Forex.

Chandler said China does not meet all of the criteria to be called a currency manipulator. Countries that qualify would have a large current account deficit; and would intervene to drive down their currency. China, he said, had a surplus this year and has been attempting to prevent its currency from weakening. A large trade deficit, however is an issue.

"The China data that came out last week showed record trade surpluses. It could be that's because of anticipated tariffs at the end of the month and U.S. corporates ordered a lot more Chinese supplies and their inventories rose as well. They might be gaming the tariffs," said Chandler.

Chandler noted that the Trump administration also plans to withdraw from a 144-year-old postal treaty, which has helped Chinese companies ship small packages into the U.S. at discounted rates, hurting U.S. competitors.

"This just illustrates to me that the Trump administration is pushing on a lot o levers to squeeze the Chinese," Chandler said.

Karen James contributed reporting.

from Top News & Analysis https://ift.tt/2yLxaLh

No comments:

Post a Comment