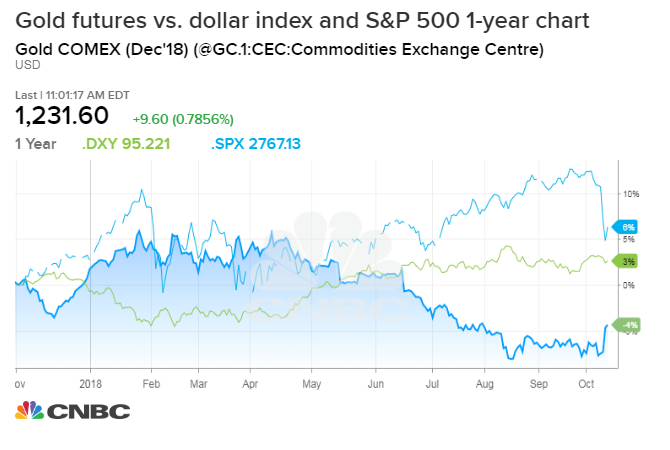

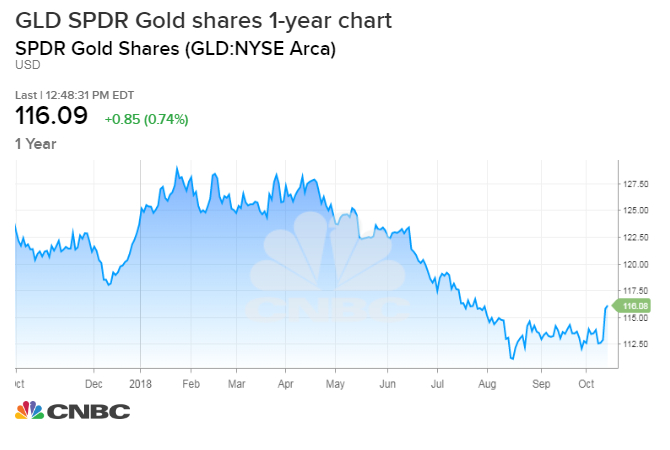

Gold prices are on the rise, after lagging through the middle part of the year, and some analysts expect the precious metal to continue moving higher into next year.

Gold futures for December rose 0.7 percent Monday to $1,230 per troy ounce, and were up 3.5 percent in the last week.

"We have a bullish outlook through the end of the year and into next year," said Jim Steel, chief precious metals analyst at HSBC. "Our average is $1,274 this year which means we'd continue to have a drive up into the end of the year...Any drop below $1,200, particularly back to the $1,160, $1,150 level, would be very well received, particularly in Asia."

Steel said the metal traded lower as the dollar gained in the second and third quarter, and safe haven flows favored the dollar and Treasurys. Steel said physical demand is picking up in China, but jewelry demand is not so strong in India, where the rupee has fallen sharply.

""It was severely oversold below $1,200. We did get a pickup in physical emerging market demand and a further reduction in scrap supply, and the market tightened a little bit and that helped it move higher," said Steel. "The real catalyst for the jerk higher in the last few days has been the equity market wobble."

Bart Melek, head of commodities strategy at TD Securities, said the stock market sell-off has been a factor, and so has the decline in the 10-year yield from its recent just above 3.25 percent back to 3.15 percent. But the risk off move may have given way to another catalyst. "Now there's a view the Fed might not be as aggressive," he said

Melek said gold should keep rising into next year, particularly as it becomes more clear how much the Fed is going to tighten. His target for the current quarter is an average price of $1,225 an ounce, and by the fourth quarter of next year, the price should average $1,325.

"Predominantly it's been a dollar story with the underlying view of the Fed and broader central bank policy working for the dollar," he said. "We had it come off and people are realizing that maybe the whole super long dollar story may not keep up and acknowledge the Fed may not remain committed to the course because of what's happening to the equity markets."

Steel said, however, the market does expect further tightening by the Federal Reserve. "Even though it's been fully digested, it would still likely provide headwinds," he said. "Even though we're bullish, we're not rabidly bullish and we remain positive on the dollar. He expects the euro, now at 1.1585 to the dollar, to slip to 1.13 this year and 1.10 next year. "That's a major reason we're not seeing significantly higher gold prices.

Steel said a huge short position in gold futures has built up, so that the market is positioned net short and that should be supportive if short sellers are forced to cover or buy gold should prices rise.

"It hasn't been short since 2001," he said. "We went net short a few weeks ago. There is the potential for a short covering rally."

Steel expects the market to remain volatile, and gold will hold on to its position as a safe haven in the long term. "If financial market volatility goes up here, there would be a lot of short covering....just look where the market was earlier in the year, we got all the way up to $1,360," he said.

No comments:

Post a Comment