Morgan Stanley is doubling down on its pessimist view for semiconductor stocks, driving the whole sector lower Thursday.

"Memory markets have worsened in recent weeks. For DRAM [memory chip], demand is weakening, inventory and pricing pressures are building, and vendors are struggling to move bits," analyst Shawn Kim said in a note to clients Thursday. "In NAND [flash memory], there is just too much supply. Earnings risks are emerging from 3Q and our cautious view on memory is playing out."

Last month the firm downgraded its rating to cautious from in line for the semiconductor industry, citing rising chip inventory levels.

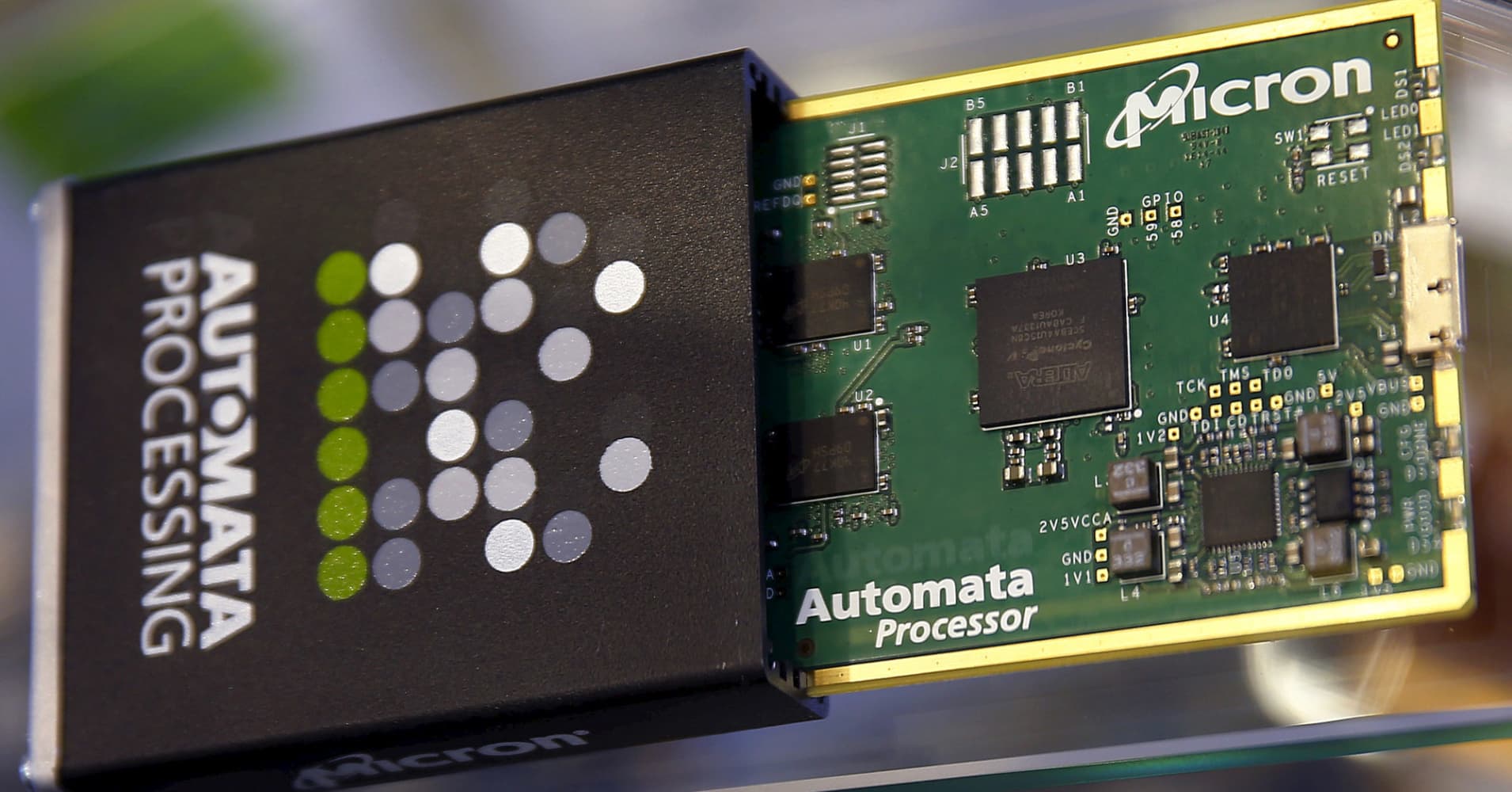

The iShares PHLX Semiconductor ETF declined 2.1 percent Thursday. Memory chipmaker Micron plunged more than 9 percent, while semiconductor equipment makers Applied Materials and KLA-Tencor dropped 3.9 percent and fell 8.5 percent, respectively.

Micron did not immediately respond to a request for comment.

-- Patti Domm contributed to report.

No comments:

Post a Comment