The Dow's first new high since January, just as the S&P 500 scored another record, is one of a number of positive signs that the bull market still has legs and could be setting up for a breakout, technical analysts say.

Stocks surged Thursday as investors pushed aside worries about trade tensions between the U.S. and China, and viewed the latest round of tariffs as less painful for the economy than expected.

At the same time, there are a handful of technical signals that make strategists believe the market could be at the beginning of another push higher.

Of course, there are headwinds that could disrupt this move, including the potential for more escalation in trade wars and rising interest rates. Some strategists are concerned about the divergence between the U.S. and other global markets.

But technicians do see a group of positive trends converging.

First, the Dow's jump above its Jan. 26 high of 26,616 was driven by strong moves in Boeing and Caterpillar, two industrial stocks that had been held back by emerging market weakness and China trade fears. The fact the Dow Jones Industrial Average made a new high, matching that in the Dow Jones Transports last week, triggered a bullish signal of confirmation for market technicians and other followers of Dow theory.

"I think that should be a Dow theory buy signal .. it means, according to the theory, the economy is supposed to be improving and therefore you have six to nine months of a higher stock market.," said Art Cashin, director of floor operations at UBS,

Boeing was up nearly 1 percent Thursday morning.

"The Dow was waiting for Boeing to start to move. It looks like it's ready. It's gone nowhere for eight months. It's had a really nice week," said Todd Sohn, technical strategist with Strategas Research.

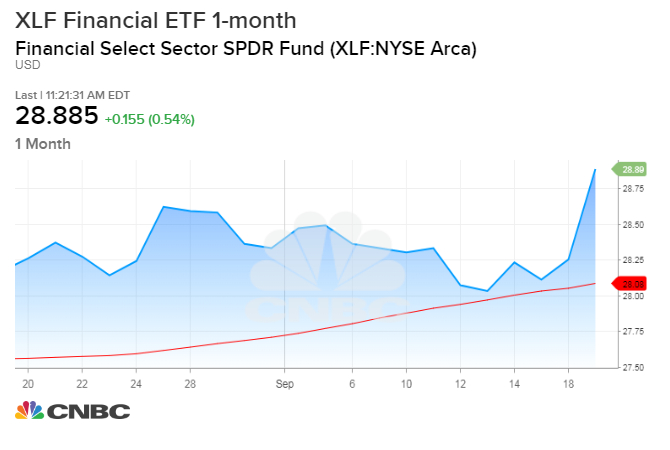

Second, financials found their footing this week, after lagging even as interest rates moved higher. Trading in the sector Wednesday laid the foundation for more gains. '

"What we look at is we had a statistically significant move. In plain speaking terms, it had the strongest move in two months, higher than average volatility," said Sohn. S&P financials were up 2 percent Wednesday. "J.P. Morgan had its best day in two months."

The Financial Select Sector SPDR Fund ETF was up 0.8 percent Thursday.

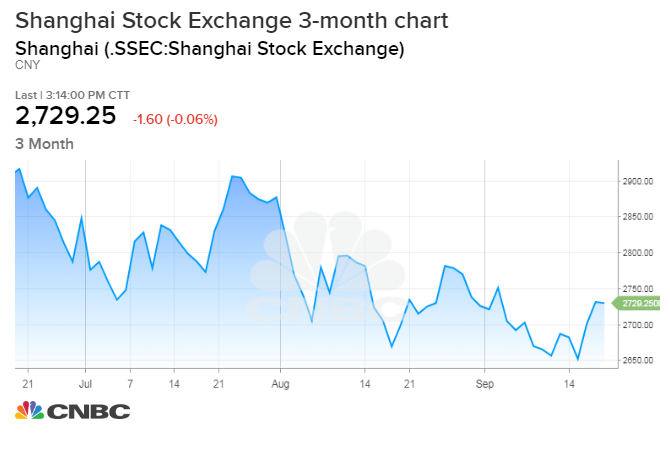

Another positive sign is that Chinese stocks seem to be weathering the latest trade actions.

"When the president came out with his tariffs, China didn't go down. It just had two potent rally days, and didn't give it back. That added a little confidence to this move, that maybe China bottomed. China has been a headwind for the past two months," said Scott Redler, partner with T3Live.com, who follows shortterm technicals.

Shanghai stocks were flat Thursday but were up 1.8 percent for the week-to-date.

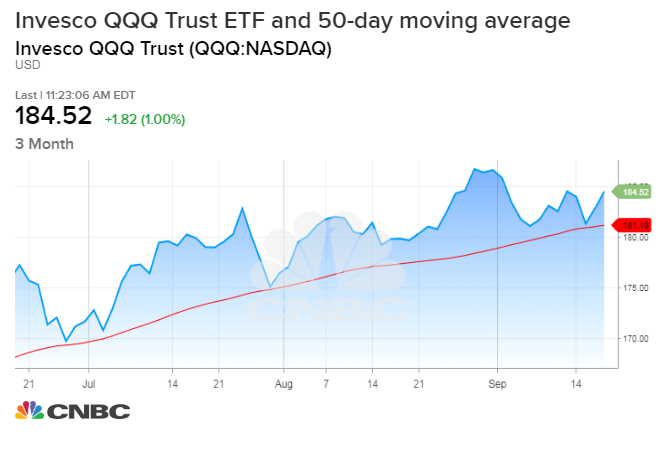

Nasdaq was up as much as 1 percent Thursday, as tech names joined the rally as the best performing sector. The S&P technology sector was up 0.15 for the week but more than 1 percent Thursday.

Redler said tech made an important move Wednesday when the QQQ, an ETF representing the Nasdaq 100, held its 50-day moving average, a sign of positive momentum.

"Tech is actually helping it along," he said. There had been doubts about technology's leadership recently, as social media, like Facebook lost ground, semiconductors declined and the sector looked vulnerable to trade actions. Apple was up 1.3 percent.

The VanEck Vectors Semiconductor ETF was up 1.2 percent Thursday, and Facebook was up 1.4 percent.

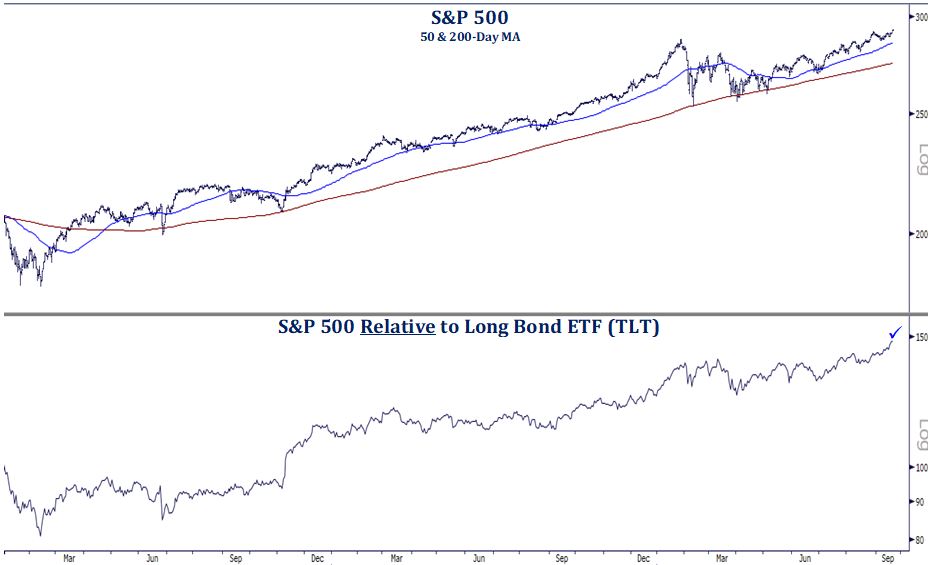

Stocks moving higher and bonds selling off is a positive sign. The jump in interest rates, with Treasury yields moving higher, has not fazed the stock market yet. The 10-year yield has risen above 3 percent and was at 3.07 percent Thursday.

"Stocks are outperforming bonds. That's the ultimate in risk appetite," said Sohn. Treasury yields move opposite price.

The S&P 500 zipped past its recent high of 2,916 and was around 2,930 Thursday.

While finanicals picked up, a laggard was the S&P utility sector, off off 0.3 percent Thursday and down 2.2 percent for the week. The sector is viewed as a safe haven, and the sector's high dividends are viewed as a good place to find yield.

Source: Strategas Research

Sohn said it's not clear at what point bond yields would challenge the stock market, but he believes it would take a yield well above current levels.

Just the fact that the Dow has caught up with the S&P and other indices that have made new highs since January and February's stock market sell off is a positive. Redler said the Dow joining in shows more broad based buying. That is important, with the market hitting highs even without FANG—Facebook, Amazon, Netflix and Google—in the lead.

"If the S&P closes above its high, the first push would go to 2,940," said Redler. "It could work its way up to 3,000 in the fourth quarter."

No comments:

Post a Comment