The stock market sell-off may not be over, but it's finally spooking some investors — and that is a good sign.

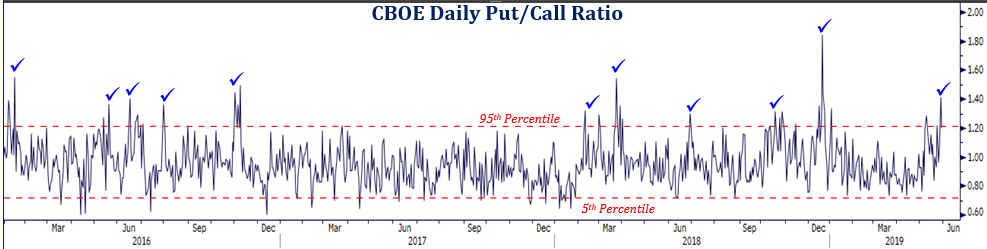

That's evident in the sharp jump in the put-call ratio, according to Strategas Research technical analyst Todd Sohn.

The put-call ratio Sohn follows measures all put and call options on the CBOE in stocks and ETFs, and it jumped to 1.4 Wednesday, the highest since December.

"That is considered an extreme, and a change in sentiment. We see it as elevated when it gets to 1.2," said Sohn. He said it means investors are getting fearful, and placing more negative bets, or puts, on stocks than calls. The ratio was at 1.2 Thursday.

"Negativity is starting to come into the market. From a contrarian perspective, I think it is necessary, for corrections to run their course," he said.

Source: Strategas Research

Sohn said he does not see the pullback as being over, and it's hard to pinpoint where the sell-off will end. "At the very least, it gives some near term relief...But I still wouldn't call the all clear yet." he said.

That's because other measures do not indicate the pull back is over yet. "You're in the ballpark, but you might need just another flush here. I 'm concerned about how small caps act," he said.

The S&P 500 is down 5.5% for the month so far, while small caps, or the Russell 2000, is down about the same. When small caps move to leadership, it is often a positive sign for stocks. In the same period, semiconductors are down about 15%.

Sohn also watches the percentage of stocks at one-month lows — another contrarian sign. "Yesterday you had 47.5 that's pretty good, but when you get above 50 and closer to 60, that's the pretty good washout," he said.

The sell off started after President Donald Trump warned May 5, in a tweet, that he could put more tariffs on China. Since then, both sides have boosted tariffs and relations have gotten tense.

"This indicator doesn't say the correction is over, but it's getting closer to the bottom. The way other stuff looks it's not quite jibing. Things went from great to odd after that one tweet," he said.

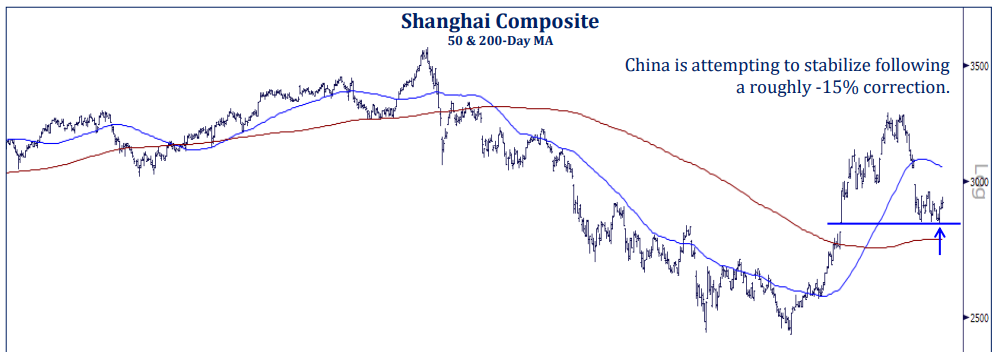

Sohn said the 5.5% decline in the S&P 500 has masked other weakness. "There are other corners of the market that are not as strong, and they need to be fixed...The semis corrected 15%, and Shanghai corrected [14%] from April 8," he said.

No comments:

Post a Comment