Hearing the superlatives applied to Wall Street's fast start — the S&P 500 up 13 percent, its best first quarter in 21 years — might leave the impression the bulls have routed the doubters decisively.

But it's closer to the truth to say that for two months bulls rebounded from the devastating loss suffered at the end of 2018 by building up a nice 12-percent lead, and then for the past few weeks the defense has held off the bears to preserve it.

The first couple of months were a supercharged "January effect," in which the smallest, riskiest, most aggressive stocks sped higher as the fourth-quarter growth panic, fund liquidations and tax-loss selling abated. Then in March a turn toward more stable, less cyclical, yield-and-cash-flow plays stepped up and small-caps sank, as bond yields rushed lower and global growth remained wobbly.

Those observers who defer strictly to the "message of the market" argue this defensive turn — combined with a furious bond rally and sudden outcry for a Federal Reserve rate cut — is a stark warning about heightened risk of recession and corporate-profit downturn.

But what about the idea that inherently strong markets find a way to support themselves even when the data soften up and risk appetites waver? Maybe the fact that the S&P 500 in March underwent only a couple of fairly benign 2 to 3 percent pullbacks despite plenty of decent excuses to buckle further is the relevant feature of this market's character

And perhaps the slight late-week lift in longer-term Treasury yields hints that the intense flight to bonds has tired itself out, releasing some pressure on financial stocks and leavening economic sentiment a bit?

Just to detail the market's defensive emphasis in recent weeks, among the industry groups with the highest proportion of stocks in a confirmed uptrend, defined as having a 50-day average price above its 200-day, are utilities, software, real estate and household products. Featured among the weakest: energy, autos, banks and transportation.

Software has been perhaps the very strongest pocket of the market before, during and since the December downturn and it is emblematic of what this market appreciates now: Strong, consistent cash flows, a secular-growth tailwind, "network" or "platform" economics that keep demand resilient and margins high.

These are often expensive stocks with lots of momentum-chasers in them, and so not defensive in the classic sense. But they aren't seen as reliant on every wiggle of world GDP for their growth, nor on the kindness of credit markets for their financing.

A conservative approach has been nicely rewarded. The classic 60 percent stocks/40 percent bonds portfolio has done unusually well. The Vanguard Balanced Index fund (VBINX), which pursues roughly this approach, has a 9.5-percent total return this year, its best quarter in nearly a decade."

Friday's 52-week high list speaks to this emphasis on stability: organic-growth consumer brands (Starbucks, Chipotle Mexican Grill, Estee Lauder, Procter & Gamble); software-based platforms (PayPal, Fiserv, ADP, Intuit); medical-tech systems (Thermo Fisher, Varian Medical, Waters); plus a smattering of industrials (Fastenal, Ametek, Ingersoll-Rand).

Deutsche Bank strategists tracking fund flows note that the only equity-fund categories with net inflows last quarter were outright defensive offerings, namely real estate, telecom, healthcare, utilities and "minimum volatility."

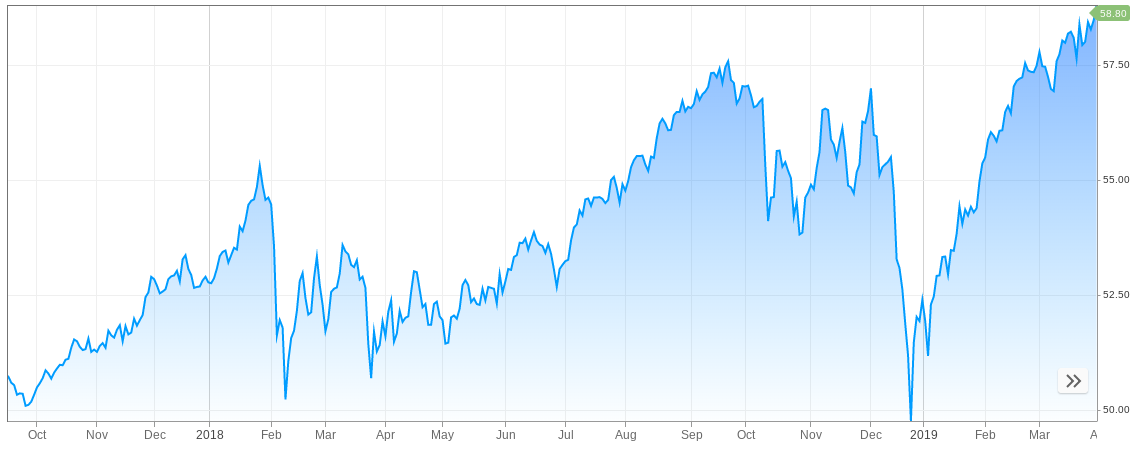

The largest in the latter category, iShares Edge MSCI Minimum Volatility ETF (USMV) has grown to $23.5 billion in assets, as investors embrace a portfolio constructed to be less jumpy than the S&P 500 yet has dramatically outperformed it. The fund is at a record high, more than 2 percent above its September peak, even as the S&P itself remains more than 3 percent below its September best.

iShares Edge MSCI Minimum Volatility ETF:

Source: CNBC

The market would likely be acting exactly the same way if it were bracing for oncoming recession or if this were simply a beneficial rotation toward sturdy groups in an economic soft patch, while the world awaits hoped-for signs of reviving China growth and a successful U.S. soft landing executed by the Fed.

The bond market's rush to price in a likely rate cut (or two) in the next year, with White House economic officials publicly pressing the Fed for a half-percentage-point easing, don't exactly fit with a consensus for still above-trend U.S. GDP growth this year, firm credit markets, tight labor conditions and forecasts for a second-half pickup in corporate-profit growth.

This dissonance also applies to the various ways the stock market's trend can be characterized. The market is up more than 20 percent in a bit more than three months — but still negative since late September as the S&P has not decisively cleared a stubborn resistance areas on its chart between 2800 and 2850. And it has gone nowhere on a net basis for fourteen months.

The bulls can lean on a few things. Very strong first quarters have tended to continue higher at least a bit through the year. Semiconductors are among the few "risk-on" groups leading things. The pullbacks, as noted, have been muted.

And, as noted, bond yields appear due to retrace some of their recent drop, quieting the jeers that say "stocks and bonds disagree about the future and bonds are usually right."

Were bonds right in November about the growth and policy path of the ensuing six months when the 10-year Treasury was way up at 3.2 percent and was nearly a full percentage point above the 3-month T-bill?

For sure, the stock market enjoys nothing more than a Fed that is far more dovish than domestic economic conditions demand (see 1998-1999). Perhaps we'll get something like this if the Fed is pulled toward the market's view of growth and inflation risks.

But either way, the clock is ticking at the start of the second quarter, as investors anxiously seek signs that the soft patch has been just that, and that companies can defend their profit margins for yet another year.

No comments:

Post a Comment