BlackRock, the largest asset manager in the world, reported better-than-expected earnings for the third quarter on Tuesday, but its revenue disappointed Wall Street.

Here is how the asset-management giant's results fared compared to analyst expectations:

- Earnings: $7.52 per share vs $6.84 expected by Refinitiv

- Revenue: $3.576 billion vs $3.648 billion forecast

- Assets under management: $6.444 trillion vs $6.498 trillion expected by StreetAccount

- Advisory, administration and lending revenue: $2.88 billion vs $2.97 billion expected

The company's assets under management totaled $6.299 trillion at the end of the second quarter.

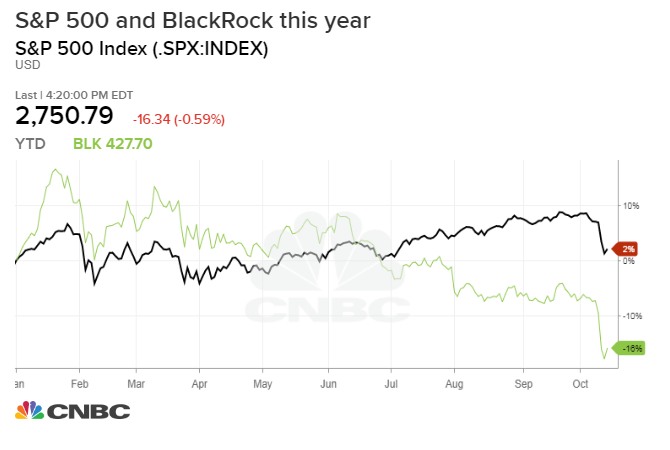

BlackRock shares are down sharply this year, falling more than 16 percent in 2018 through Monday's close. Meanwhile, the S&P 500 is up nearly 3 percent year to date.

The report comes after BlackRock completed in late September the acquisition of Citibanamex's asset management business, which has about $34 billion in assets.

This is breaking news. Please check back for updates.

—BlackRock CEO Larry Fink is scheduled to appear on CNBC's "Squawk Box" Tuesday after the results are released.

from Top News & Analysis https://ift.tt/2AdvqME

No comments:

Post a Comment