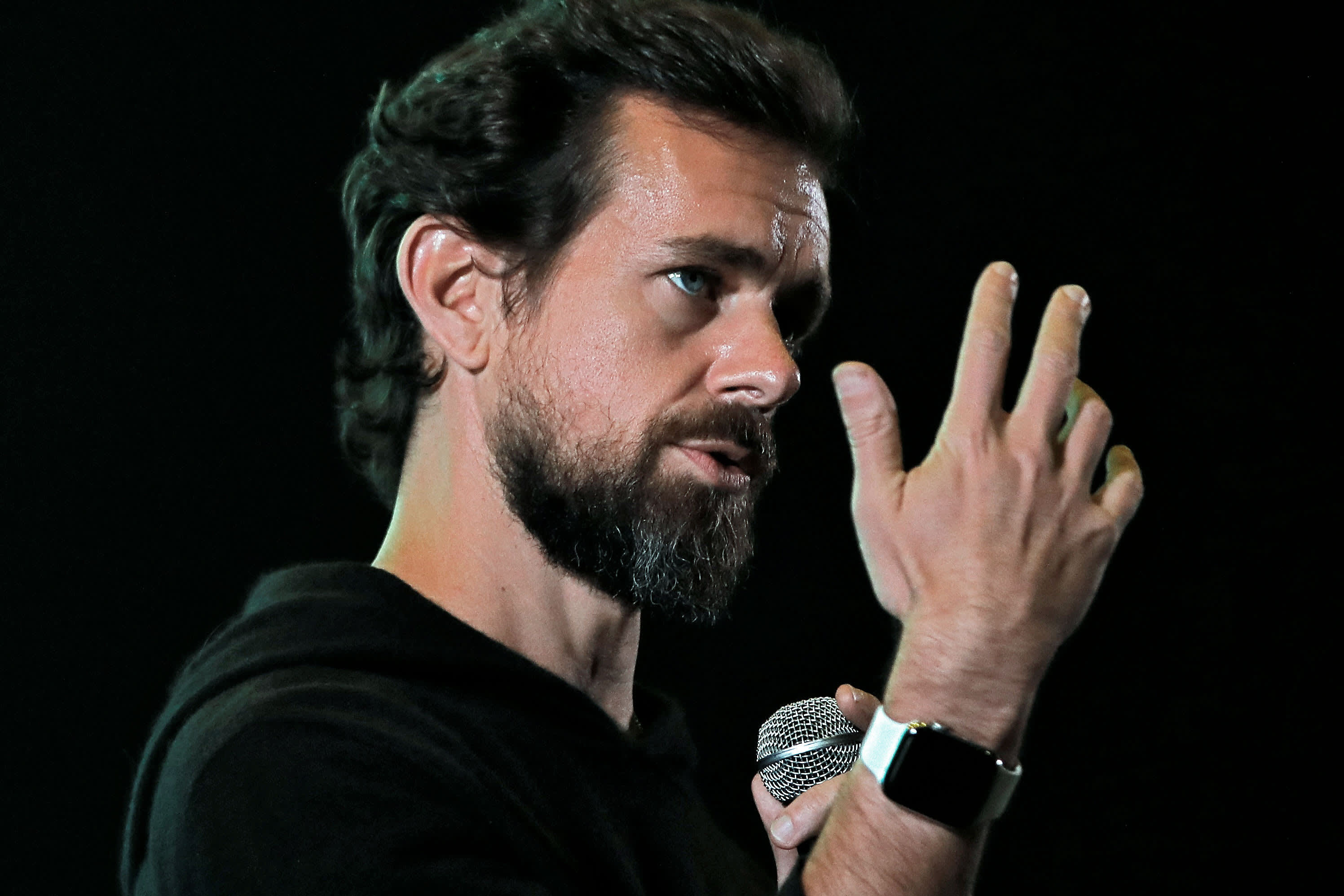

Twitter CEO Jack Dorsey addresses students during a town hall at the Indian Institute of Technology (IIT) in New Delhi, India, November 12, 2018.

Anushree Fadnavis | Reuters

Square shares dropped after the company reported weaker-than-expected gross payments volume and lowered its guidance for the second quarter.

The payments company did beat Wall Street estimates on earnings and revenue.

Here's how the company did vs. what Wall Street expected:

- Earnings: 11 cents per share vs. 8 cents per share, forecast by Refinitiv

- Revenue: $489 million vs. $478 million, forecast by Refinitiv

Shares of the company fell more than 7 percent in after-hours trading. The stock is up more than 25 percent year to date. In the past year, the stock has surged more than 50 percent.

San Francisco-based Square, run by Twitter CEO Jack Dorsey, is well-known in the payments sector for its credit card processor, payment hardware and popular Cash app. It has also moved into small business lending through Square Capital.

Last quarter, Square reported fourth-quarter earnings and revenue that beat analysts' expectations but came up slightly short on first-quarter guidance. Subscription- and services-based revenue, a metric analysts watch closely, was a bright spot last quarter.

Square's peer-to-peer Cash App reported more than 15 million monthly active customers in December 2018, doubling from a year earlier.

The payments company announced it hired Amrita Ahuja as its new chief financial officer in January after former CFO Sarah Friar stepped down last year. Ahuja held the same position at Blizzard Entertainment, a division of Blizzard.

— This is breaking news. Please check back for updates.

No comments:

Post a Comment