Apple could be about to give away its crown as the largest company to Microsoft, which has the unusual distinction of returning to number one after a hiatus of 16 years.

Microsoft briefly surpassed Apple on a stock market value basis early Tuesday, but then both stocks came off their lows and Apple returned to the top. Analysts expect Microsoft to surpass Apple again and possibly trade as the largest company by market value for awhile, but don't count the iPhone maker completely out.

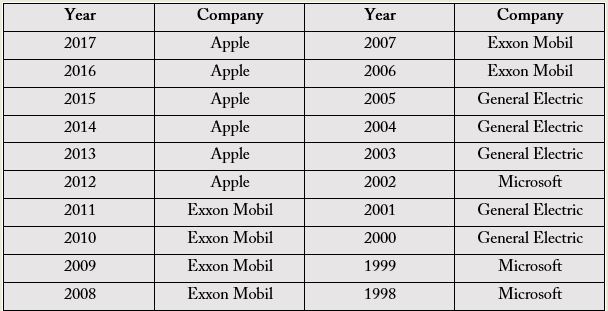

Source: S&P Dow Jones Indices

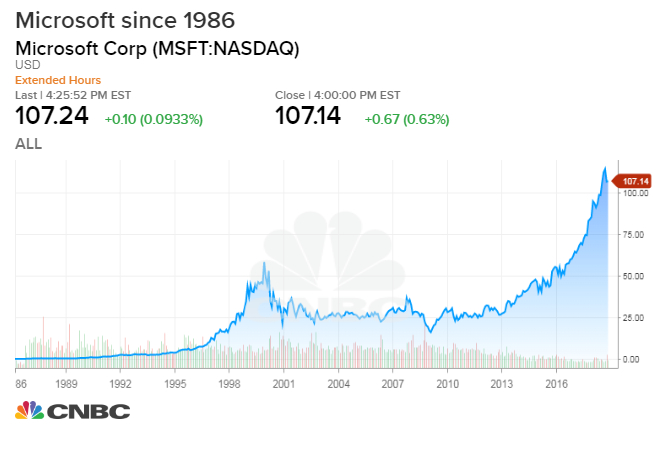

Microsoft's recovery has been slow and steady. "If you look back over the last four years, it's hard to sneeze at how well it's done. Ever since [CEO Satya] Nadella came in and changed the focus," said Paul Hickey, co-founder of Bespoke. "It was able to reinvent itself and successfully."

Apple was worth $826.8 billion Tuesday afternoon, while Microsoft was at $822.4 billion. Apple has been crushed recently by worries about iPhone sales and the tech selloff, just months after it surpassed the $1 trillion mark.

Ironically, when Microsoft was on top in December 1999, it was worth $604 billion, while Apple was a slender $16.5 billion, according to S&P Dow Jones Indices data. Microsoft was number one again in 2002, after the tech bubble burst but with a much smaller market value of $276.4 billion.

Hickey said Microsoft isn't getting the credit it deserves. "We've seen companies like IBM And GE that haven't been able to withstand changes in the overall business environment," he siad. "Microsoft is working on the whole subscription business...and it's really getting in front of trends."

Apple has been the biggest company by market cap, since 2012, based on year-end data from S&P Dow Jones Indices.

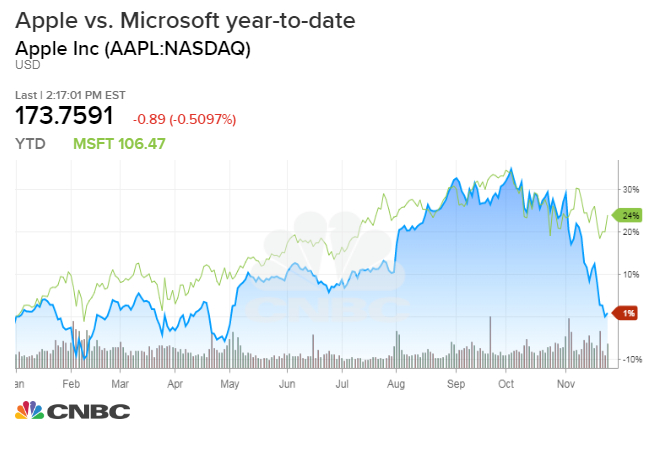

Even if Microsoft surpasses Apple, the software company does not have the market sway of Apple, which has impacted sentiment and trades with the momentum names in tech. Apple has fallen 22.8 percent since Oct. 1, and Microsoft is down just 6.3 percent in the same time frame.

"Microsoft has just been slowly going on in the background there, and almost under peoples' radar. It's down but it's held up better than the market. It didn't get caught up in all the excitement we saw in a lot of other stocks," said Hickey. "You look at both of them. They have identical dividend yields right now, 1.7 percent."

Hickey said it's really not unusual for a stock to fall out of favor, and now it's Apple's turn, something that it has experienced before.

"Maybe the only company that's reinvented itself better than Microsoft is Apple but that was 15 years ago...They've constantly been rivals to each other with each taking turns in the lead," said Hickey.

Apple's stock is now well below the average Wall Street target of $232, at $174.24, while Microsoft, at about $107.14 at Tuesday's close, was just about $20 below the average analyst's target.

"Microsoft was an example of a company that was a monopoly and became too powerful. I think under this new leadership they figured it out. Whether they deserve to be larger than Apple, I don't know," said Jack Ablin, CIO at Cresset Wealth Advisors. "One of the things about Microsoft, I don't think their customers are passionate about them. Their business and their brand is a serviceable utility, but as for Apple, people go out of their way to align themselves with Apple and that brand. That's impressive."

Still, the market has been rewarding Microsoft and Ablin said in reinventing itself Microsoft has finessed a recurring revenue model. "Apple, for as great as it is, draws most of its revenue from one-time sales," he said.

There are just a small group of 11 companies that have been number one, going back to 1925. AT&T, as the former Ma bell, held that title for 59 years, while IBM was at the top for 21, according to S&P Dow Jones data. Exxon was the biggest company for several years in the mid-2000s.

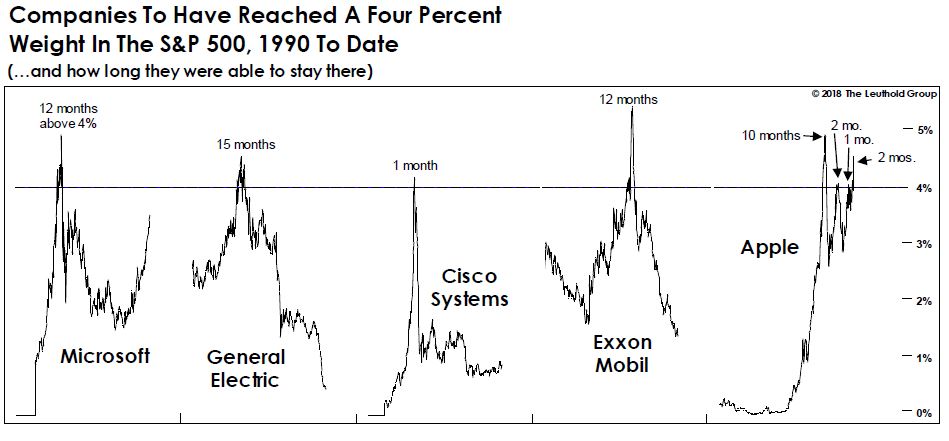

As the biggest company, stocks typically also have the biggest market clout. Apple had been more than 4 percent of the S&P when it was riding high this summer, but it is now at 3.6 percent to Microsoft's 3.4 percent.

Source: Leuthold Group, Sept. 2018

Leuthold Group looked at stocks of companies that were in what it calls the "4 percent club," meaning those that had four percent. They noted the last time Microsoft was the largest company, it was at 4 percent of the market, as was General Electric and Cisco, in an unusual consolidation of power.

"It's just so unique over the course of history. There are so few companies that have breached that mark," said Krisitn Perleberg, portfolio manager at Leuthold. "The bad part is they generally aren't able to stay there. Apple was just so unique in that they were able to come in and come out...In the past, it's been an ominous sign, but with Apple it's different."

Silverblatt said the weight of Apple is small compared to IBM in its hey day, or AT&T when it was 5.5 percent of the market in 1981. After the break up of American Telephone and Telegraph, the new AT&T slipped to number five largest company in 1983, from number two in 1982 and number one in 1981.

"Relatively [Apple and Microsoft] are the biggest," said Howard Silverblatt, senior index analyst at S&P Dow Jones Indices. "They don't wield as much power compared to the six percent IBM was at in the 1980s...They don't wield as much power as some other names did."

Silverblatt said the market clout of the biggest stocks also spreads through the market because of the shares of suppliers and vendors connected to them. But the mighty can also fall. General Electric was number one for nine years, but now it is No. 82 with a market cap of $65.8 billion and its stock trade in single digits.

— With reporting by Tom Franck

No comments:

Post a Comment