U.S. crude prices surged more than 2 percent on Monday, hitting a nearly four-year high on signs that sanctions are shrinking Iranian crude exports and as North American trade tensions ease.

International benchmark Brent crude prices rose as much as $84.77, hitting their highest level since November 2014. The contract was last up $1.96, or 2.4 percent, at $84.69.

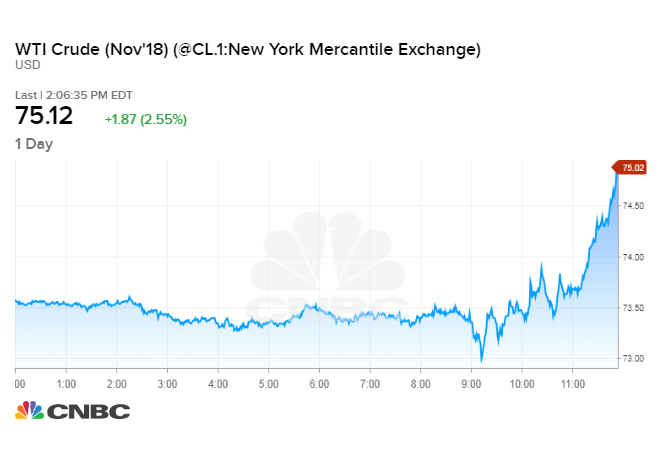

U.S. West Texas Intermediate crude rose $1.85, or 2.5 percent, to $75.10, having hit a three-month high. WTI cane within a few cents of its 2018 high at $75.27, its best intraday price in nearly four years.

Oil prices rose after the United States, Canada and Mexico announced they had agreed on a path forward for the North American Free Trade Agreement, or NAFTA. A trade dispute among the three trading partners has raised fears of a slowdown in growth that could impact oil demand.

"The stock market is loving it. It unleashes some more economic activity. It should enable Mexico to buy some crude oil off of us," said John Kilduff, founding partner at energy hedge fund Again Capital.

The market was also bouncing on news that China's Sinopec has cut crude imports from Iran in half ahead of the Trump administration's Nov. 4 deadline for oil buyers to cut imports of Iranian supplies.

Questions have lingered about whether China, the world's second biggest crude consumer, would comply with the U.S. sanctions.

The National Iranian Oil Company's deal to build a crude oil storage facility at the port of Oman is also being viewed as tacit acknowledgment that Iran expects the market for its crude to shrink, Kilduff said.

U.S. sanctions on Iran, OPEC's third biggest oil producer, are expected to wipe roughly 1 million barrels a day off the market by the end of the year.

John Driscoll, chief strategist at JTD Energy Securities says $100 a barrel oil now looks possible, if not inevitable. He noted that benchmark Oman oil on the Dubai Mercantile Exchange — which reflects the cost of sending Saudi crude to Asia — recently spiked above $90 a barrel.

"It almost signaled a psychological panic-type buying," he told CNBC. "We're moving into a world where you have lower inventories, lower spare capacity, less protection for buyers, and this kind of sent a shot across the bow."

However, rising oil prices threaten to cut oil demand in emerging economies.

"This could trigger inflation. This could trigger substitution of other fuels for energy," Driscoll said. "It ultimately will have a long-term effect on demand. We'll be back into that cycle of boom-bust."

No comments:

Post a Comment