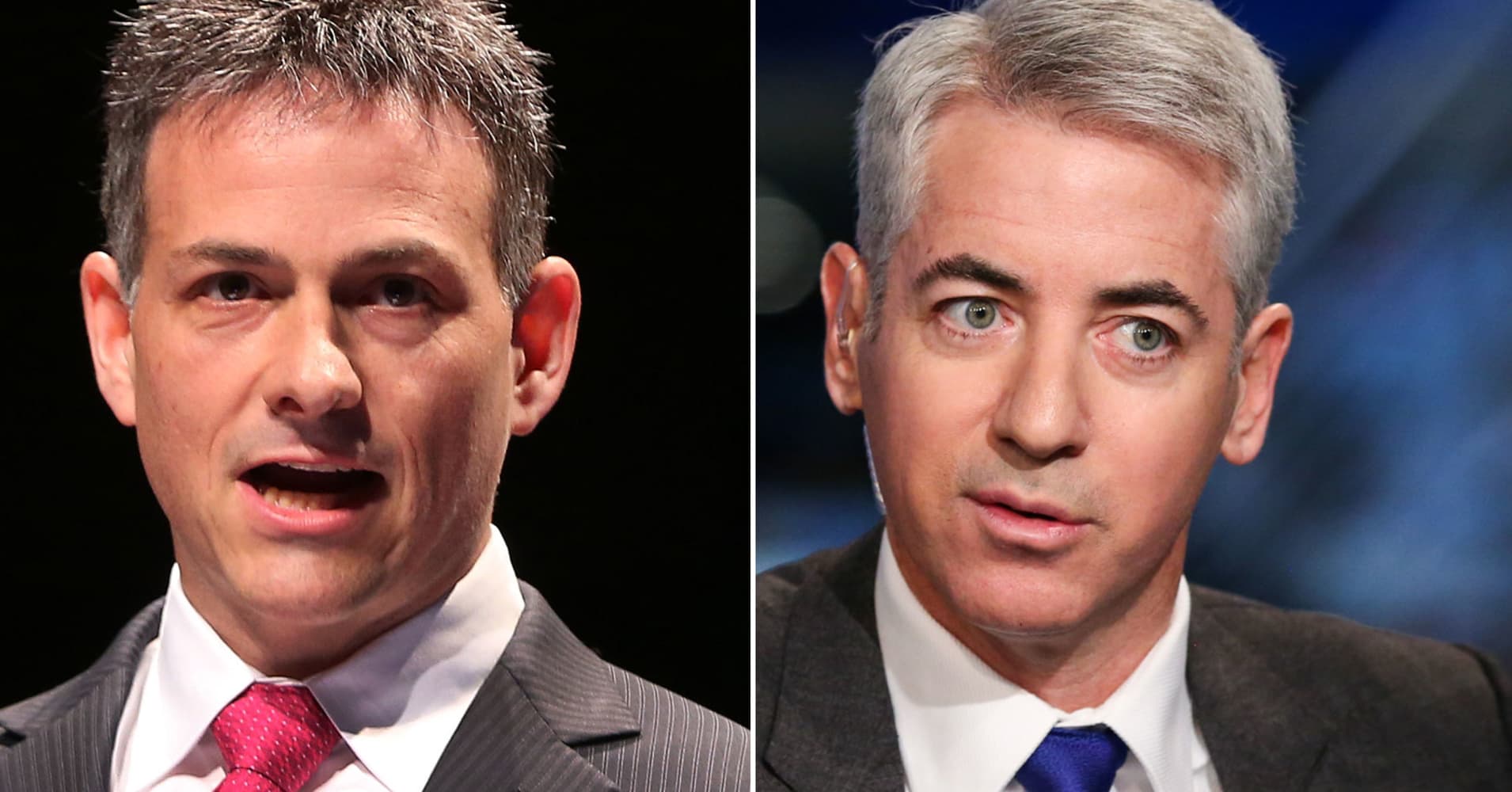

Billionaire investor David Einhorn's Greenlight Capital hedge fund, whose bets on car companies General Motors and Tesla both moved against him in August, lost 7.6 percent this month, leaving the fund down 25.1 percent for the year, two investors said on Friday.

Einhorn sent investors his monthly update after the market closed on Friday but gave no specific reason for the fresh losses, people who received it said.

Shares of General Motors, one of Einhorn's largest holdings, fell 3.4 percent.

Greenlight is also one of a handful of hedge funds that took a short position on Tesla - betting that the stock would fall.

That took a toll when Tesla founder Elon Musk shocked markets in early August by tweeting that he was mulling taking the company private.

Tesla's stock, after rising and then falling during the month, fueled by Musk's decision to remain a public company after all, ended the month up, hurting short sellers.

Einhorn investors have been losing patience with him for some time and have been pulling money out. August's numbers could prompt more departures at year-end when the manager will next let investors redeem money, one person said.

An Einhorn spokesman declined to comment.

At the same time, Daniel Loeb's Third Point, currently pushing Nestle to spin off units and working on getting Campbell Soup to put itself up for sale, posted only tiny gains in August. His Third Point Partners fund inched up 0.1 percent, leaving it up 0.9 percent for the year-to-date, an investor said.

William Ackman, the third in the trio of managers who for many years shared many of same investors, has swung to big gains this year, and his private hedge fund is up roughly 15 percent for the year, an investor said.

His gains have been fueled by strong performances at Automatic Data Processing, Chipotle Mexican Grill and Lowe's Companies, one of his more recent investments.

The average hedge fund has fallen roughly half a percent this year, preliminary numbers from Hedge Fund Research show.

from Top News & Analysis https://ift.tt/2wuEsTm

No comments:

Post a Comment